By the end of last week, the US dollar managed to partially recover and stabilize against the main currencies on the wave of profit-taking by short-term investors, who actively sold it for the last two New Year's Eve.

The rate of the US currency was not able to exert negative influence even a weak report on the number of new jobs that the US economy received in December. According to the data presented, the number of new jobs increased by 148,000, which is much worse than the consensus forecast of growth of 190,000. But positive was the November values, which were revised upwards to 252,000. The unemployment rate remained unchanged at 4.1 %, which is still the lowest value since the beginning of the 2000s.

Positive for the dollar were the figures for the average hourly wage, which in December added 0.3% against the November increase of 0.1%. The annual value of the indicator showed an increase of 2.5% against the increase of the previous year by 2.4%. But, despite the positive dynamics, it can hardly be said that such a rate of average wage growth will energetically push consumer inflation in the US upwards, which by its braking, or rather, the inflation component of the price index for personal consumption (RFE), restrains the activity of investors in dollar purchases.

Considering the probable prospects in the currency markets this week, one can say that the dollar can receive local support on the wave of profit-taking by short-term investors, as well as against dollar purchases returned from the holidays by bidders. We have previously repeatedly pointed out that the dollar at the beginning of the new year may be under pressure or, at best, remain in the "outset" in relation to major currencies. This situation is conditioned, on the one hand, by the desire of market players to look at the impact of the new tax reform on the dollar from the point of view of attractiveness of investing in dollar assets, and on the other hand, the expectation of signals from the world's largest securities, primarily the ECB and Bank of England, about the possible change in their monetary rates in the direction of tightening in the new year.

Forecast of the day:

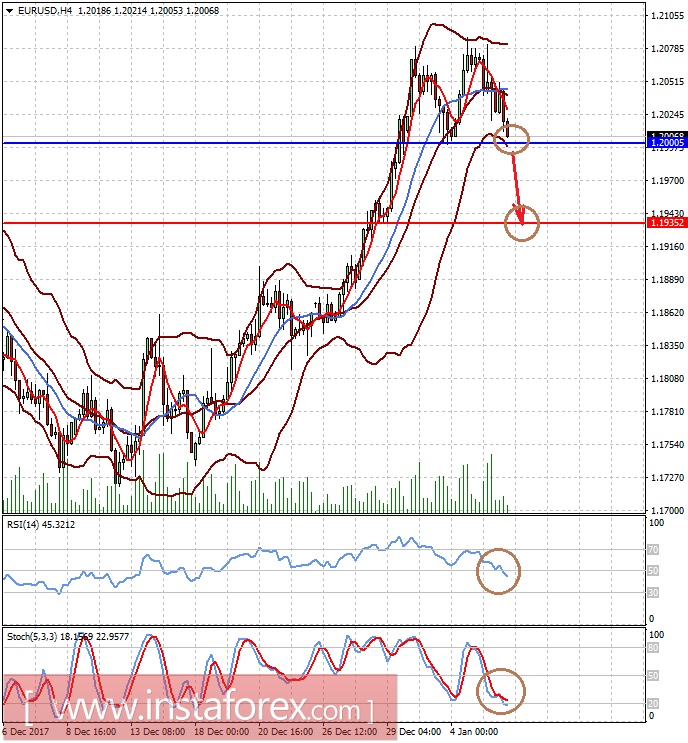

The pair EUR/USD forms the reversal pattern "double top". Overcoming the "neck" line of the 1.2000 mark may lead to its implementation with the price falling to 1.1930-35.

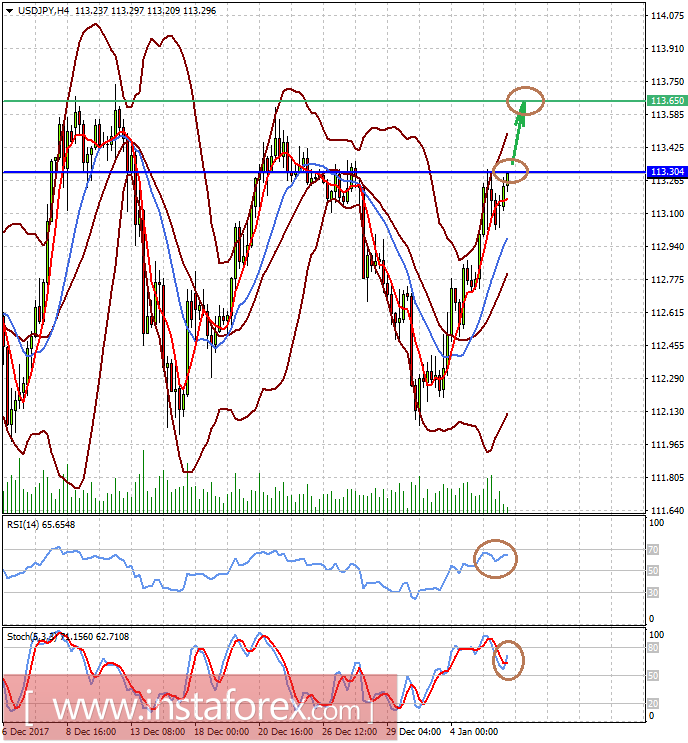

The pair USD/JPY pair is testing the resistance level of 113.30, overcoming it on the general wave of dollar exchange rate recovery in the currency markets may lead to an increase in price to 113.65.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română