The euro did not receive serious support from investors after the release of good data on industrial production in the euro area. However, the publication of the minutes from the December meeting of the European Central Bank forced traders to change their view of risky assets.

In the first half of the day, it became known that Germany's economy in 2017 grew at a slower pace than expected. According to the report of the Federal Bureau of Statistics of Germany, Germany's gross domestic product grew by 2.2% last year. Despite this, economists expected a more serious growth rate in the region of 2.3%. The surplus of the country's budget in 2017 amounted to 1.2% of GDP.

Given the economic indicators demonstrated by Germany in 2017, it is not surprising that this country is the basis of the eurozone and the European Union as a whole. However, given the difficulties now faced by German Chancellor Angela Merkel in her post, it can be assumed that it is political problems that indirectly affect the main financial indicators in early 2018.

As I noted above, the industrial production of the eurozone completes the year with an excellent upward trend. According to the report of the EU statistical agency Eurostat, industrial production in November 2017 increased by 1.0% compared to the previous month and by 3.2% compared to the same period of the previous year. Economists predicted that growth will be at 0.6% compared to the previous month and 2.9% compared to the same period of the previous year.

The publication of the minutes of the meeting of the European Central Bank provided substantial support to the euro, as many investors found in them a hint of a possible curtailment of the asset repurchase program by the Central Bank this fall.

The minutes indicate that the ECB can change its attitude to the credit policy in case the state of the economy continues to improve in 2018. The leaders also agreed that the policy should change gradually so as not to affect the recovery of the euro area economy.

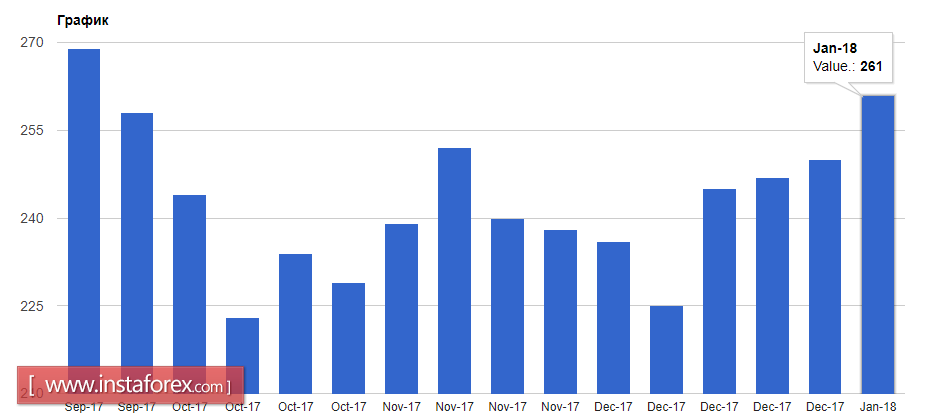

Weak data on the US labor market exerted even more pressure on the US dollar. According to the report of the US Department of Labor, the number of initial applications for unemployment benefits for the week of December 31 to January 6 increased by 11,000 and amounted to 261,000. Economists had expected the number of applications to be 245,000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română