Dear colleagues.

For the EUR / USD pair, the continuation of the development of the upward trend from January 9 is expected after passing the price of the noise range of 1.2212 - 1.2231. For the GBP / USD pair, we follow the development of the upward structure on January 11. For the USD / CHF pair, we follow the downward structure of January 10. For the USD / JPY pair, we follow the development of the downward structure from January 8. The continuation to the bottom is expected after the breakdown of 110.68. For the EUR / JPY pair, we follow the development of the upward structure from January 10. The continuation to the top is expected after the breakdown of 135.70. For the GBP / JPY pair, we are monitoring the formation of the potential for the top of November 11.

Forecast for January 15:

Analytical review of currency pairs in the scale of H1:

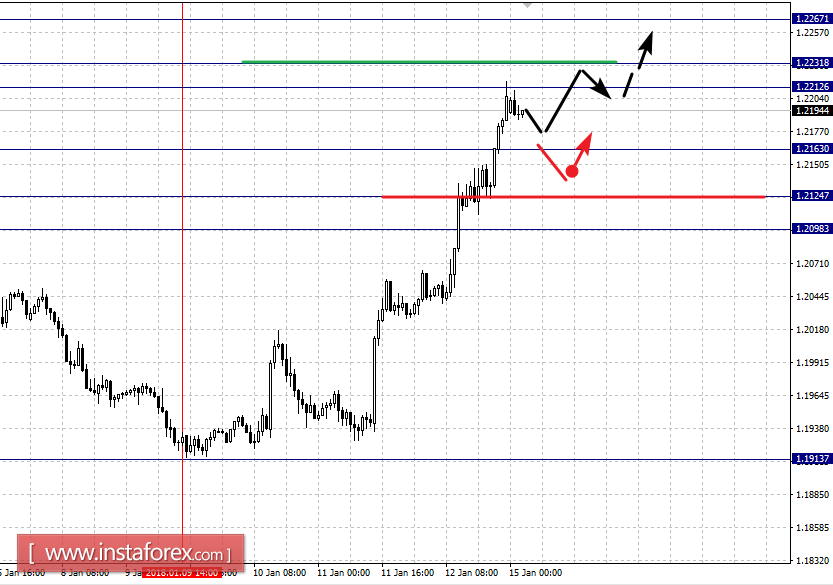

For the EUR / USD pair, the key levels on the scale of H1 are: 1.2267, 1.2231, 1.2212, 1.2163, 1.2124 and 1.2098. Here, we continue to follow the upward structure of January 9. Continued movement towards the top is expected after passing the price of the noise range at 1.2212 - 1.2231. In this case, the target is 1.2267. From this level, we expect a pullback to the bottom.

Correction is possible after the breakdown of 1.2163. In this case, the target is 1.2124. The range of 1.2124 - 1.2098 is the key support for the top. Passing the price will lead to the development of the downward structure.

The main trend is the upward structure of January 9.

Trading recommendations:

Buy: 1.2233 Take profit: 1.2265

Buy Take profit:

Sell: 1.2160 Take profit: 1.2126

Sell: 1.2123 Take profit: 1.2100

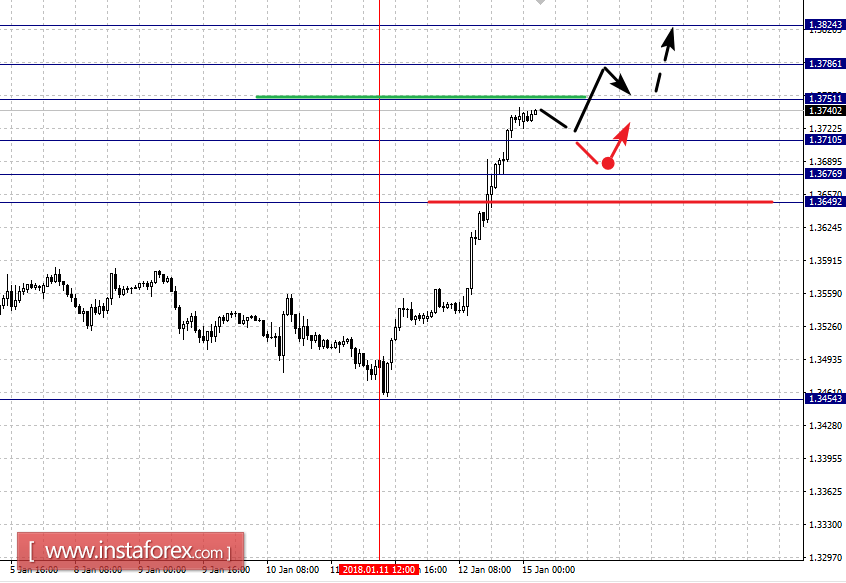

For the GBP / USD pair, the key levels on the scale of H1 are 1.3824, 1.3786, 1.3751, 1.3710, 1.3676 and 1.3649. Here, we follow the upward structure of January 11. Continued movement towards the top is expected after the breakdown of 1.3751. In this case, the target is 1.3786. Near this level is the consolidation of the price. For the potential value for the top, consider the level of 1.3824. Upon reaching this level, we expect a pullback to the bottom.

The movement towards the correction is possible after the breakdown of 1.3710. Here, the target is 1.3676. The range of 1.3676 - 1.3649 is the key support for the top.

The main trend is the upward cycle of January 11.

Trading recommendations:

Buy: 1.3751 Take profit: 1.3784

Buy: 1.3788 Take profit: 1.3822

Sell: 1.3710 Take profit: 1.3678

Sell: 1.3674 Take profit: 1.3652

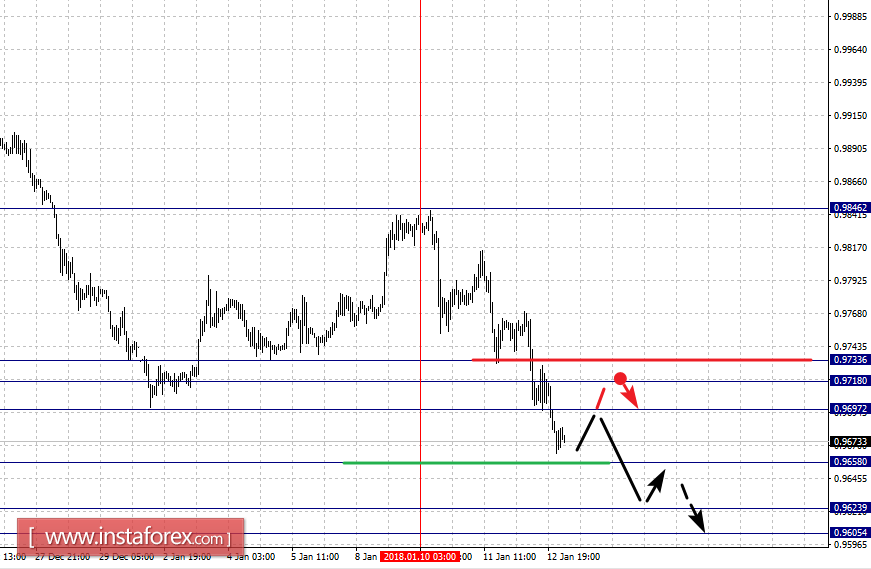

For the of USD / CHF pair, the key levels in the scale of H1 are: 0.9733, 0.9718, 0.9697, 0.9658, 0.9623 and 0.9605. Here, we follow the downward structure of January 10. Continued movement towards the bottom is expected after the breakdown of 0.9658. In this case, the target is 0.9623. In the area of 0.9623 - 0.9605 is the consolidation of the price.

Going into correction is expected after the breakdown of 0.9697. Here, the target is 0.9718. The range of 0.9718 - 0.9733 is the key support for the downward cycle.

The main trend is the downward structure of January 10.

Trading recommendations:

Buy: 0.9698 Take profit: 0.9718

Buy: Take profit:

Sell: 0.9655 Take profit: 0.9625

Sell: 0.9621 Take profit: 0.9607

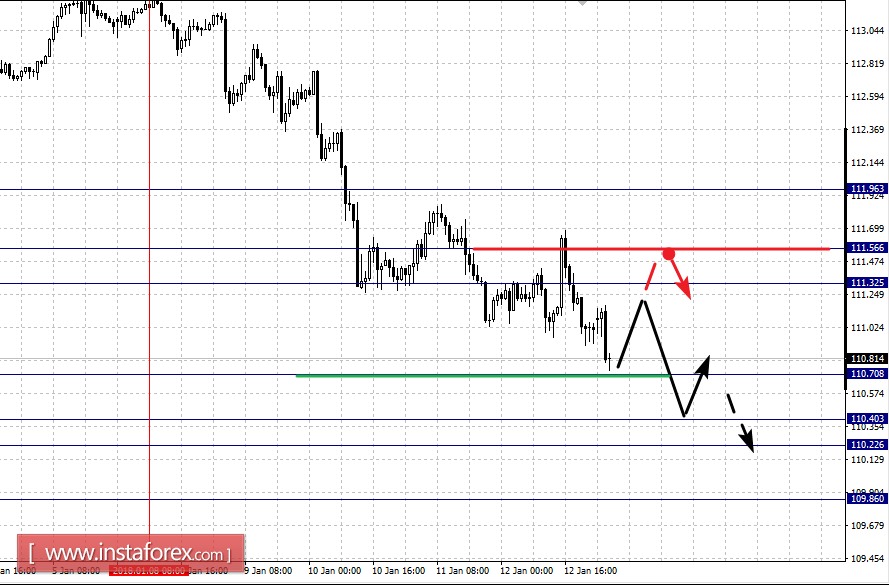

For the USD / JPY pair, the key levels on the scale are: 111.96, 111.56, 111.32, 110.70, 110.40, 110.22 and 109.86. Here, we continue to follow the downward structure from January 8. Continued movement towards the bottom is expected after the breakdown of 110.70. In this case, the target is 110.40. In the area of 110.40 - 110.22 is the consolidation of the price. For the potential value for the bottom, consider the level of 109.86. From this level, we expect a pullback to the top.

Short-term upward movement is possible in the area of 111.32 - 111.56. The breakdown of the last value will lead to in-depth correction. Here, the target is 111.96. This level is the key support for the downward structure.

The main trend is the downward cycle from January 8.

Trading recommendations:

Buy: 111.32 Take profit: 111.55

Buy: 111.60 Take profit: 111.94

Sell: 111.65 Take profit: 110.45

Sell: 110.20 Take profit: 109.88

For the CAD / USD pair, the key levels on the H1 scale are: 1.2676, 1.2649, 1.2601, 1.2577, 1.2533, 1.2447, 1.2420 and 1.2354. Here, the continuation of the development of the upward structure of January 5 is expected after the breakdown of 1.2533. In this case, the first target is 1.2577. Passing the price of the noise range at 1.2577 - 1.2601 must be accompanied by a pronounced upward movement. Here, the target is 1.2649. In the area of 1.2649 - 1.2676 is the consolidation of the price.

Short-term downward movement is possible in the area of 1.2447 - 1.2420. This range is the key support for the upward structure and passing the price will lead to the development of a downward trend. In this case, the target is 1.2354.

The main trend is the upward structure from January 5, the stage of deep correction.

Trading recommendations:

Buy: 1.2535 Take profit: 1.2575

Buy: 1.2604 Take profit: 1.2645

Sell: 1.2420 Take profit: 1.2560

Sell: Take profit:

For the AUD / USD pair, the key levels in the scale of H1 are: 0.7991, 0.7964, 0.7948, 0.7927, 0.7901, 0.7887, 0.7858. Here, we continue to follow the upward structure of January 9. Continued movement towards the top is expected after the breakdown of 0.7927. In this case, the target is 0.7948. In the area of 0.7948 - 0.7964 is the consolidation of the price. For the potential value for the top, consider the level of 0.7991. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 0.7901 - 0.7887. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7858. This level is the key support for the top.

The main trend is the formation of the potential for the top of January 9.

Trading recommendations:

Buy: 0.7930 Take profit: 0.7948

Buy: 0.7966 Take profit: 0.7990

Sell: 0.7901 Take profit: 0.7888

Sell: 0.7885 Take profit: 0.7863

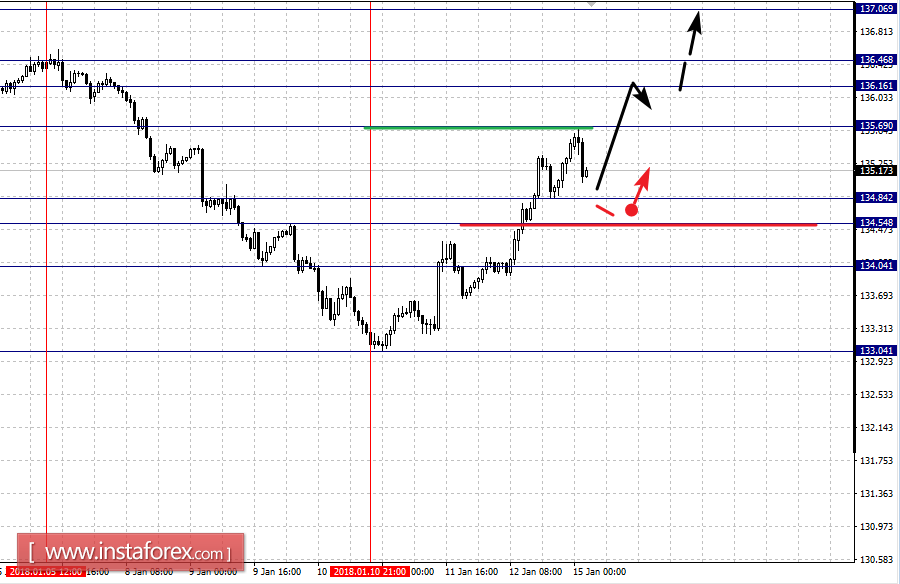

For the of EUR / JPY pair, the key levels on the scale of H1 are: 137.06, 136.46, 136.16, 135.69, 134.84, 134.54 and 134.04. Here, we follow the upward structure of January 10. Continued movement towards the top is expected after the breakdown of 135.69. In this case, the target is 136.16. In the area of 136.16 - 136.46 is the consolidation of the price. For the potential value for the top, we consider the level of 137.06. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 134.84 - 134.54. The breakdown of the last value will lead to in-depth correction. Here, the target is 134.04. This level is the key support for the top.

The main trend is the upward structure of January 10.

Trading recommendations:

Buy: 135.70 Take profit: 136.15

Buy: 136.48 Take profit: 137.05

Sell: 134.82 Take profit: 134.55

Sell: 134.52 Take profit: 134.10

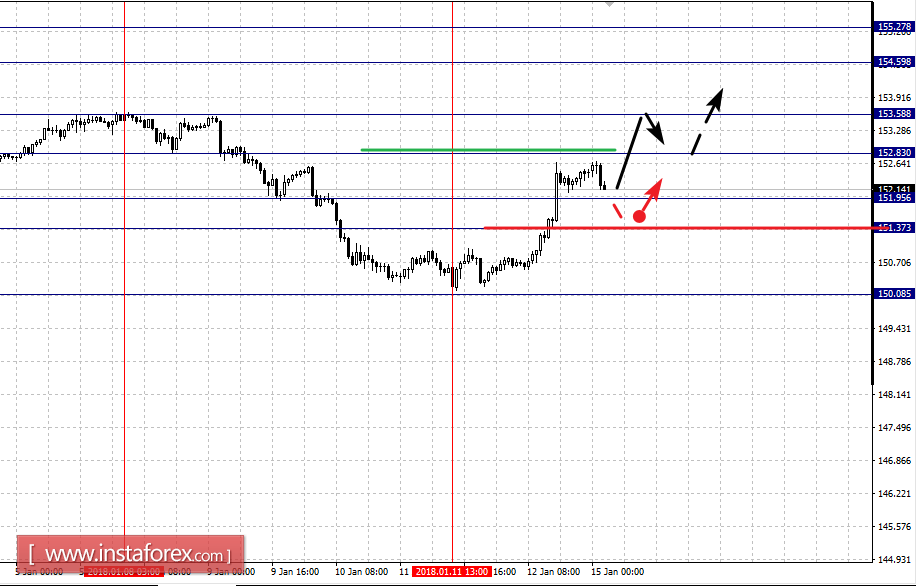

For the GBP / JPY pair, the key levels on the scale of H1 are: 155.27, 154.59, 153.58, 152.83, 151.95, 151.37 and 150.08. Here, the price forms the potential for the upward movement of January 11. Continued movement towards the top is expected after the breakdown of 152.83. In this case, the target is 153.58. Near this level is the consolidation of the price. A break of the level of 153.60 should be accompanied by a pronounced upward movement. Here, the target is 154.59. For the potential value for the top, consider the level 155.27. Upon reaching this level, we expect a rollback to correction.

Short-term downward movement is possible in the area of 151.95 - 151.37. The breakdown of the last value will lead a downward structure. Here, the target is 150.10.

The main trend is the formation of the upward potential from January 11.

Trading recommendations:

Buy: 152.85 Take profit: 153.50

Buy: 153.62 Take profit: 154.55

Sell: 151.95 Take profit: 151.45

Sell: 151.33 Take profit: 150.15

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română