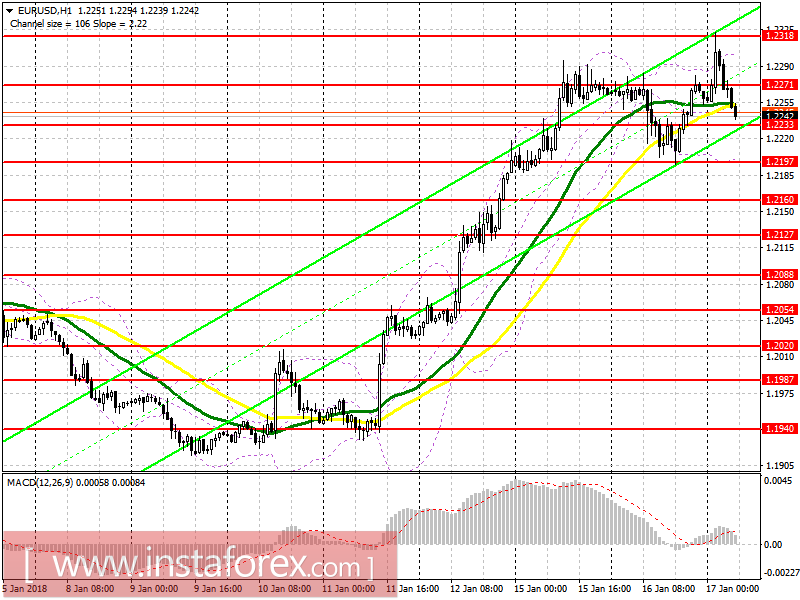

EUR/USD

To open long positions on EURUSD, it is required:

Much will depend on the data on inflation in the eurozone. The return and consolidation at the level of 1.2271 will be a strong signal to increase long positions in the euro with the expectation of updating 1.2318 and further exit to new monthly highs in the area of 1.2383 and 1.2426. Also long positions on the euro can be observed in the event of a false breakdown at 1.2233 and a rebound from 1.2197.

To open short positions on EURUSD, it is required:

The formation of a false breakout at 1.2271 and a return to this level, together with weak inflation data, may lead to a correction of the euro in the morning to the support area of 1.2197, and consolidation below this range will lead to a selling to a stronger 1.2160 level. In case of further growth above 1.2271, consider the new short positions best after the test 1.2318 or on the rebound from 1.2383.

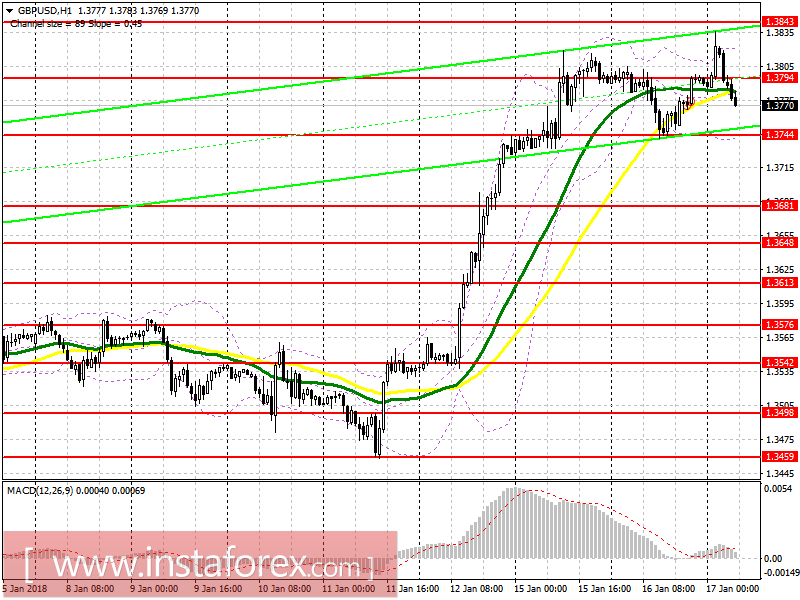

GBP/USD

To open long positions on GBPUSD, it is required:

The return to 1.3794 level will be a good signal to increase long positions in the pound for the renewal of 1.3843 and continuation of growth in the region of new highs in the 1.3894 area and 1.3970, where it is recommended to lock in the profit. In the case of a pound drop in the morning, long positions can be seen on a false breakout near 1.3744 or buying GBP/USD immediately on a rebound from 1.3681.

To open short positions on GBPUSD, it is required:

The formation of false breakdown at 1.3794 will be the first signal to a possible downward correction after strong growth. The consolidation below the intermediate support 1.3744 will completely collapse GBP/USD to the area of 1.3681 and 1.3648, where it is recommended to lock the profit. In case of further growth of the pound by the trend above 1.3794, it is advised to open short positions only after updating 1.3843 or on a rebound from 1.3894.

Descriptors

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română