As a result of the meeting of the Japanese Central Bank, nothing new has happened. Markets hoped that the regulator would continue the idea of reducing the volume of asset purchases, as announced earlier this year. But that did not happen.

The bank left the previous course of monetary policy unchanged, explaining this by low inflation and pointing out that changes should be expected only when inflation reaches a target level of 2.0%. Earlier, after the unexpected decision of the Central Bank to reduce the volume of asset purchase by 5%, the markets were inspired and decided that this year, the regulator will follow the Fed's path and after the termination of stimulus measures, it will start raising interest rates. But this did not happen, although the yen grew against the major currencies at the same time, as the market stubbornly continues to believe that the bank will still return to this topic this year. Supports these positive sentiments primarily the decision of the Central Bank mentioned above to reduce the volume of purchases of 10 and 25-year government bonds at the beginning of this year.

If, in any case, in the near future with the plans of the Japanese Central Bank is all the less clear, the outcome of the ECB's meeting is still unclear. Most market players are still of the opinion that the bank this year will decide on stopping incentive measures. Prerequisites for this are really there. This is economic growth, as well as a reduction in the volume of asset purchase, which the regulator made last fall. But there is a significant obstacle in the form of braking inflation at 1.4%, which is noticeably below the target level of 2.0%. Based on this, the outcome of the meeting may turn out to be similar to the Japanese one, which may disappoint market players and put local pressure on the euro.

In general, assessing the prospects of the currency market, we note that, most likely, before the meeting of the ECB and the publication of important economic data this week, the market trend will prevail against the backdrop of hopes and uncertainty.

Forecast of the day:

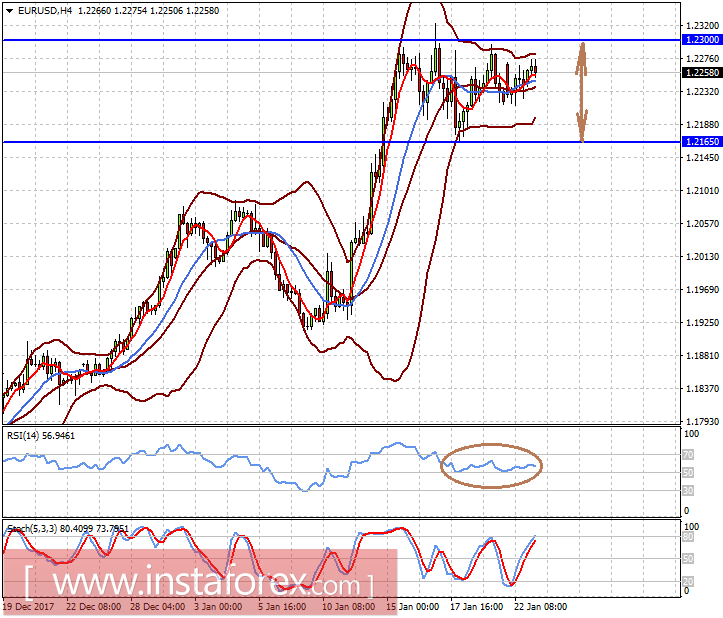

The pair EUR/USD remains in the range of 1.2165-1.2300 amid investors' expectations of the outcome of the ECB meeting to be held on Thursday, 25th of January. Most likely, the pair will stay in this range today.

The pair GBP/USD after a noticeable growth on the eve of the wave of hopes that the situation with the release of Britain from the EU in the near future will be resolved can be adjusted to 1.3925, although it still maintains the upside potential to 1.4050.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română