EUR / USD, GBP / USD.

The events on Tuesday happened in the calm of the previous days, as the macroeconomic data of the European countries came out good, while some of the largest investors to ascend in the evening. In particular, strong investors were satisfied with the decline in the UK's Public Sector Net, with a reduction of 6.65 billion pounds to 0.98 billion pounds, against the expectations of 4.2 billion pounds. As a matter of fact, the United Kingdom made a "horses for courses", considering the borrowed amount of 1.2 billion euros from the EU. However, the deficit is very noticeable with this operation. The index of UK industrial orders declined from 17 to 14 in January, but the pound was supported by the positive data from the euro area. The German business sentiment index ZEW in January rose from 17.4 to 20.4, while using the same indicator of the whole eurozone, showed an increase from 29.0 to 31.8, against the expectation of weaker growth to 29.7. The consumer confidence index in the eurozone this month rose from 0.5 to 1.3 (0.6 forecast).

In the United States, the business activity index in the manufacturing sector of Richmond for January fell from 20 to 14 against the forecast of 19. Counter dollar currencies continued to rise.

It is expected that the business activity data for the euro area will be based on the preliminary estimate for January. The Manufacturing PMI may fall from 60.6 to 60.4, while Services PMI is projected at 56.5 points against 56.6 earlier.

The United Kingdom is expected to improve its labor market. 5.9 thousand to 5.4 thousand. The average wage including bonuses for the last three months is expected to increase by 2.5%. The unemployment rate is expected to remain unchanged at 4.3%.

The expectations in the United States are mixed. Home sales in the secondary real estate market for the month of 5.72 million YoY against 5.81 million YoY in November. The Services PMI in Markit's valuation in January is expected to increase from 53.7 to 54.5. The Manufacturing PMI from Markit can increase from 55.1 to 55.2. The house price index in November is expected to grow by 0.4%. The balance of economic indicators, of course , has a more positive connotation.

On the same day, data on crude oil reserves are released. A decrease of 1.0 million barrels is forecasted against -6.8 million of the previous week, which could strengthen the bullish sentiment of investors and could indirectly affect the dollar weakening. Oil traders derive optimism in the intention of OPEC countries plus to extend cutbacks in production until 2019.

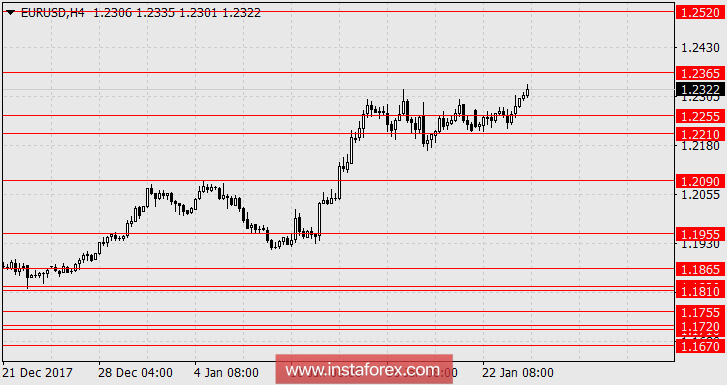

As a result, it is expected that the British pound will increase its optimistic labor data, with the target at 1.4150. The euro will grow despite the possible weakening of the PMI, reaching 1.2365 due to the ECB's decision tomorrow to change the QE tone ( "strengthening communication"), and with a further target at 1.2520.

USD / JPY.

Yesterday, an important event for investors took place which is the Bank of Japan's decision on monetary policy. But the results of the meeting, "communication" with market participants, disappointed the investors. Against the backdrop of maintenance economic forecasts without change; the GDP for the current year has come in at 1.4% YoY, core inflation at 1.4% YoY for 2019, GDP growth at 0.7% YoY and 1.8% YoY in inflation. The head of the Central Bank Haruhiko Kuroda only stated the inexpediency of making adjustments to the current QE plan in the long term. The Japanese yen strengthened in correlation with the dollar but lost 60 points.

The alertness of the Bank of Japan yesterday became clearer this morning since the trade balance for December showed some devaluation. Taking into account seasonal fluctuations, the Trade Balance fell from 0.36 trillion yen to 0.09 trillion yen. It further approaches the transition to the negative area, from which the economy came out in November 2015. The growth of exports decreased from 16.2% YoY to 9.3% YoY, while imports also slid from 17.2% YoY to 14.9% YoY. The business activity index in the manufacturing sector of Japan for January's preliminary assessment grew from 54.0 to 54.4 but failed to hold back the yen's decline. And what can we say about PMI, if the Bank of Japan itself did not express a desire to help the national currency ...

The stock market of Japan loses -0.65% against yesterday's growth of the American S & P500 by 0.22%. In Chinese, the China A50 came in at -0.32%. We are expecting for the yen at the following levels: 109.30, 108.70.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română