According to the presented statistics, the index of current economic conditions from ZEW in Germany jumped to 95.2 points in January against the expectation of growth to 89.8 points and the previous value of 89.3 points. Another index of economic sentiment from ZEW in Germany for the month of January rose sharply to 20.4 points against 17.4 points, while it was assumed that the indicator will grow to only 17.8 points. The value of the same indicator, but only for the eurozone, also did not disappoint and showed growth to 31.8 points against the forecast of an increase to 29.7 points and the previous value of 29.0 points. The data of the consumer confidence index in the euro area for the month of January were also strong, rising to 1.3 points against 0.5 points in December and the forecast of an increase to 0.6 points.

The values of the presented indicators were really inspiring but it did not immediately support the euro. This seemed strange but it can be explained by the fact that, on one hand, investors are probably in the state of anticipation while waiting for the results of the ECB meeting on monetary policy which will be held tomorrow, on Thursday. On the other hand, the markets seem to be also waiting for approval in the the US Senate appointed new head of the Fed, J. Powell, whose candidacy was finally approved on Tuesday.

In the wake of this message, the dollar was again under pressure. The reason for this is quite trivial. We have previously pointed to this and are just allowing ourselves to repeat it. It is believed that Powell will pursue a very cautious monetary policy. At best, he will follow the current course of J. Yellen, which is characterized by a smooth process of raising interest rates and constant monitoring of economic statistics, especially the values for consumer inflation.

The market believes that in the moment of braking inflationary pressures, Powell can pause in raising rates, for example, at the March meeting. Naturally, on the wave of these sentiments, the dollar remains under pressure which, as we assumed earlier, will continue until the end of the first quarter.

Forecast of the day:

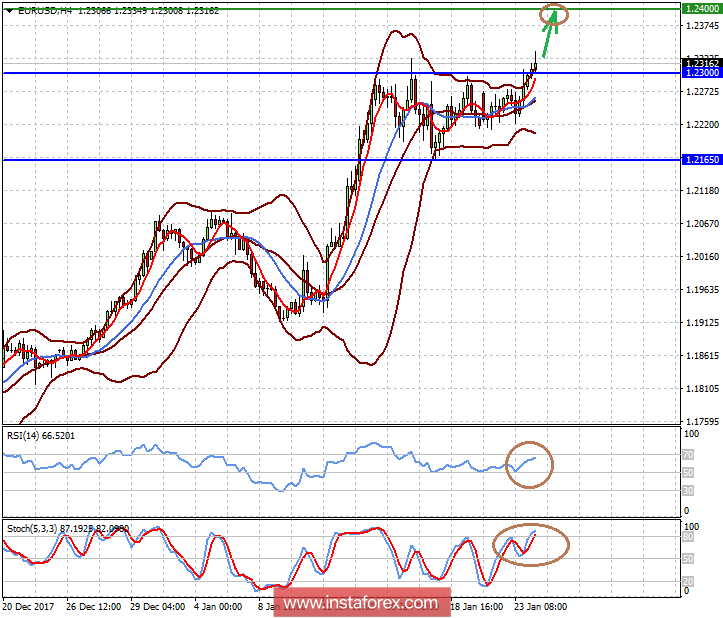

The EURUSD pair broke out of the range of 1.2165-1.2300 against the backdrop of positive data on the economy of Germany and the euro area as well as approval of the candidacy of J. Powell for the position of head of the Federal Reserve. We can assume that if the pair holds above 1.2300, it can continue to grow today to 1.2400.

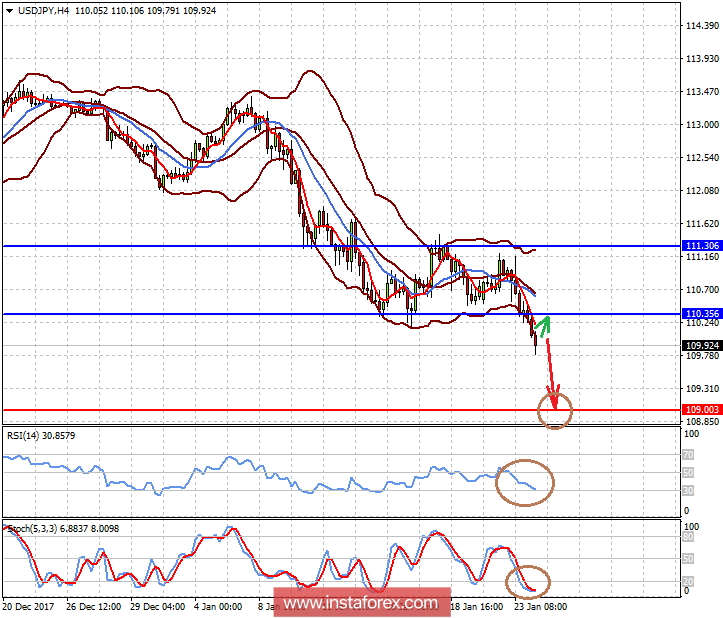

The USDJPY pair escaped from the range of 110.35-111.30. It is locally resold, which can lead to a rebound to 110.30 if the price can be prevented from rising. This could be the reason for the pair to continue falling to 109.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română