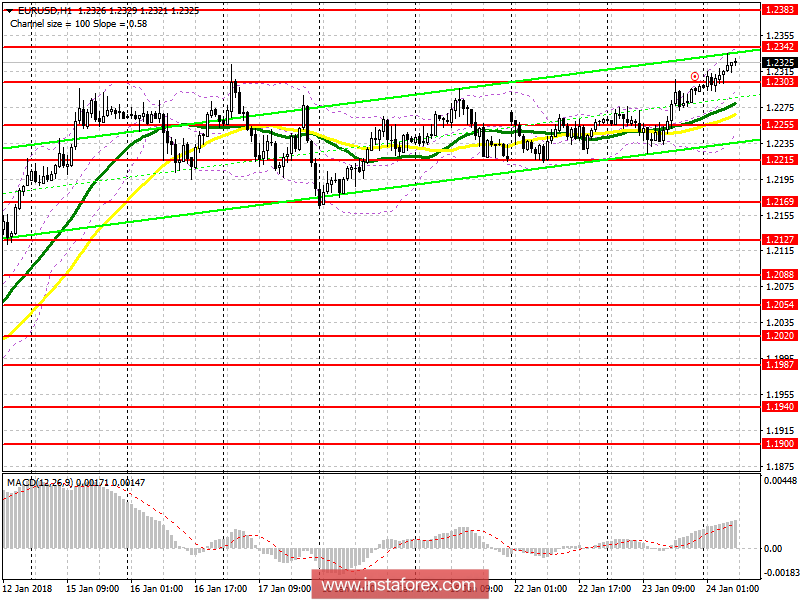

EUR / USD pair

To open long positions for EUR / USD pair, you need:

While trading is above 1.2303, the upward momentum can be relied on and a consolidation at While trading is above 1.2303, the upward momentum can be relied on and a consolidation at 1.2342 will bring new customers back to the market. This could lead to the renewal of new weekly highs near 1.2383 and 1.2426, where fixing profits are recommended. In the case of a decline of the euro under the level of 1.2303 in the morning, new long positions can be opened on the rebound from 1.2255.

To open short positions for EUR/USD pair, you need:

The formation of a false breakout at 1.2342 and a return to this level can lead to a correction of the euro to the support area of 1.2303 in the morning. Fixing below this range will lead to a sale on a stronger 1.225 level, where fixing profits are recommended. In the case of growth above the level of 1.2342, it is best to consider new short positions after the test at 1.2383 with the formation of a false breakdown there, or on a rebound from 1.2426.

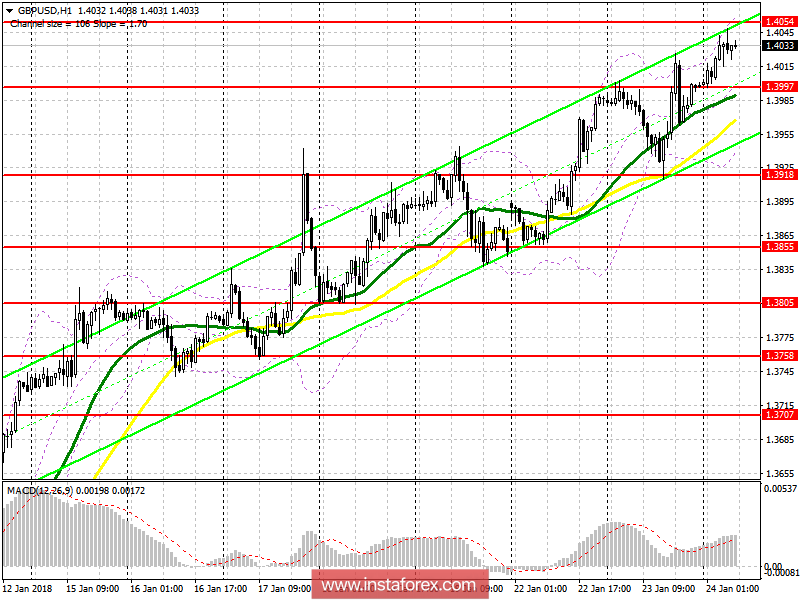

GBP / USD pair

To open long positions for GBP / USD pair, you need:

The formation of a false breakout in the area of 1.3997 may allow the British pound to continue its upward trend with a breakout and consolidation above 1.4054, which will open the way for new highs in the 1.4106 and 1.4155 areas, where fixing profits are recommended. In the case of a decline below the level of 1.3997, long positions can be calculated after the test of 1.3918.

To open short positions for GBP / USD pair, you need:

The formation of a false breakout at 1.4054, which will be confirmed by a divergence on the MACD indicator may lead to a larger sale of the pound and its correction to the area of 1.3997. Fastening below this range will hit a number of stop-orders from buyers that will crash the GBP/USD pair in the area of the larger support 1.3918, where fixing profits are recommended.

Indicators description

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

To familiarize with the basic concepts and the general rules of my TS is possible here.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română