EUR / USD, GBP / USD.

The main impetus for yesterday's growth of the euro and pound was set by the US Treasury Secretary Steven Mnuchin, saying at the Davos Economic Forum about the advantages of American trade with a weak dollar. Over the past three years, we have heard for the first time such a message from American policymakers (except Donald Trump) who did not pay attention to the higher levels of the dollar. Obviously, Mnuchin did not mean this in the literal sense, and investors understood the speech of former vice-president Goldman Sachs and CEO of the hedge fund SFM Capital Management in the right direction. They began to sell the dollar against all currencies. Later, the mixed eurozone PMI data came out. The business activity in the sphere of services increased in January from 56.6 to 57.6, while expectations of a decrease to 56.5. The activity in the manufacturing sector declined from 60.6 to 59.6, while expecting a smaller decline to 60.4. In the UK, the number of applications for unemployment benefits in December decreased from 12.2 thousand to 8.6 thousand, but the forecast assumed a decrease to 2.3 thousand. The situation was helped by a good rate of increase in wages. Salaries with premiums in November increased by 2.5%, excluding premiums by 2.4% while waiting for 2.3%.

The data on the US came out also mixed and generally moderately negative, but this gave confidence to the market participants in buying counter-dollar currencies. Sales of houses in the secondary real estate market for December amounted to 5.57 million against 5.78 million in November and a forecast of 5.72 million. The PMI services for January fell from 53.7 to 53.3, the forecast assumed growth to 54.5. The manufacturing PMI showed growth of 55.5 versus 55.1 in December. The index of house prices in November increased by 0.4%, at the forecast level.

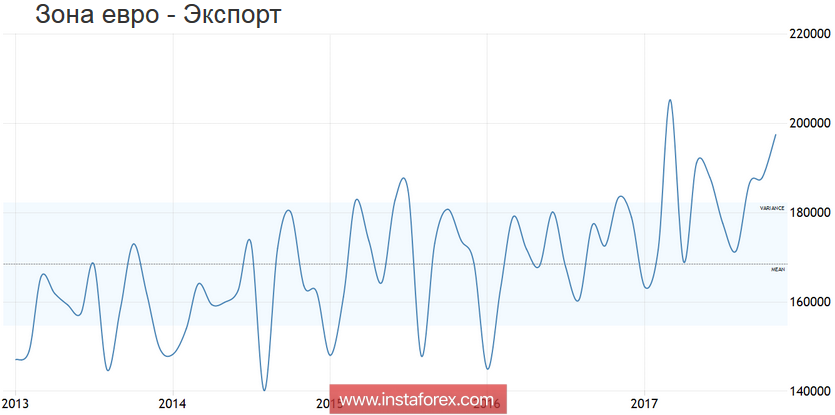

Today, the main event of the day will be the announcement of the ECB's monetary policy decision. The press conference of Mario Draghi will start at 13:30 London time. Earlier, we are waiting for the head of the ECB to confirm the information by analytical agencies about the acceleration of the rate of QE reduction. The main issue offered by the business media to Draghi's speech is the high euro exchange rate, which is hindering European producers. But such a message is largely provocative. In 2015-16, when the euro was at the lows since 2003, eurozone exports were significantly smaller than in 2017, when the euro rose vertically upwards:

At the same time, industrial production fell far from the best:

It is not difficult to see that in fact, the economy of the eurozone was pulled by the US, which began to grow since 2016. This happened almost always. The economy of Europe followed the rise in the US in 3-4 months:

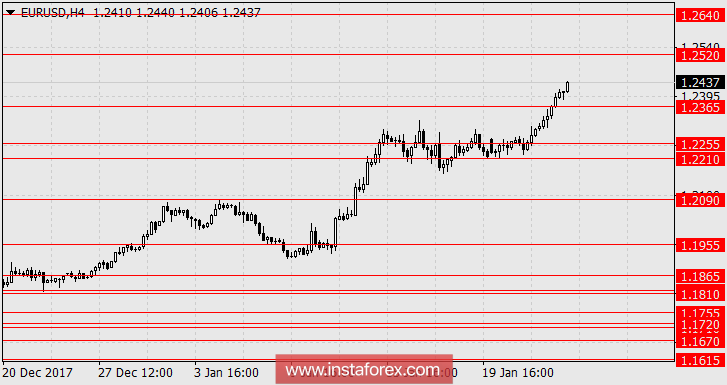

Thus, Mario Draghi will not even mention whether the euro is acceptable now or "requires careful monitoring." Globally, the corridor 1.23-1.30 suited everyone even after the crisis. Investors, not having received justifications for fears, with renewed vigor, can continue buying a single currency.

The data for the USA today are expected to be mixed. The sales of new homes in December are projected at 676 thousand against 733 thousand in November, the trade balance for December could improve from -70 billion dollars to -68.6 billion dollars. Wholesale stocks for December are expected to grow by 0.3%, growth of leading economic indicators by 0.5%.

We are waiting for the euro at 1.2520 with a prospect at 1.2640. According to the British pound, remembering its speculative grandeur (the greatest volatility in the 90s and early 00's), we expect growth to 1.4500.

AUD / USD.

The Australian dollar, like the New Zealand dollar, as well as European currencies, and also as commodities, is growing at the global dollar weakening. The representatives of the RBA no longer mention the high level of the national currency, which is also a characteristic of global trends. The iron ore went up by 0.33% ($ 76.21), Brent + 0.39%, Light Sweet + 1.43%. Copper added 3.76%, nickel 5.48% (!), Wheat 2.69%.

The macroeconomic index of Australia's leading indicators for November showed an increase of 0.3% after rising 0.1% in October. Today there is no data, all the attention investors will be focused on the ECB meeting, especially since tomorrow is a public holiday in Australia.

We are looking forward to the growth of AUD / USD to 0.8240.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română