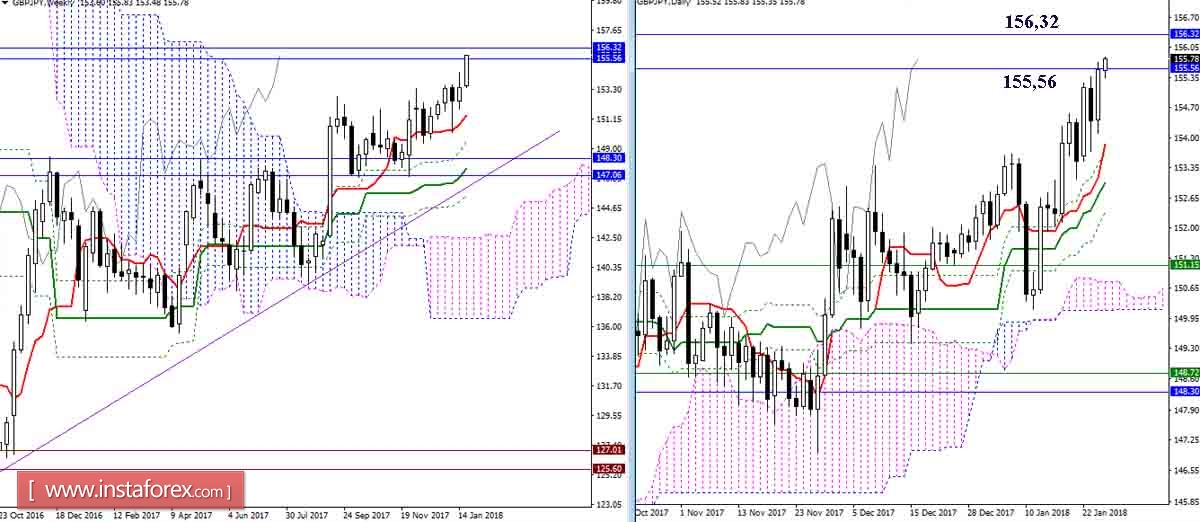

GBP / JPY

Despite the reversal movements in the lower timeframes, the interaction with the resistance zone encounter (monthly Kijun 155.56 + Senkou Span B 156.32) continues. Today, the GBP/JPY pair is testing the levels again.

Support for Kijun N4 and H1 clouds coped again with the task and could not only defend the advantages of bulls but also give them the necessary forces to restore the trend. At the moment, we could see an uptrend in its active phase and all elements of the Ichimoku indicator support the rising players. The significant benchmarks in the way of bulls continue to be monthly resistance (155.56 - 156.32). The nearest support today can be noted at 155.56-45 (monthly level + Tenkan H1) - 154.97 (Tenkan H4 + Kijun N1) - 154.46 (Kijun H4 + cloud H1), then the main value will be the H4 cloud supported by daytime cross levels.

EUR / JPY

Yesterday, the daytime Tenkan helped the players to raise and gave them support but the level has risen today towards the center of attraction (the monthly Senkou Span A 135.74), which means that it will no longer actively monitor the bulls interests unlike before. For players on the fall, maintaining their position at 135.74 will open the road to day-time Kijun at 134.56. Fixing the EUR/JPY pair above the 135.74 level will shift the strength of the forces to the side of the bulls, and the main task of is to exit the consolidation zone and update the maximum boundary (136.56).

The pair used the support and returned to the center of the consolidation zone. As a result, the expectations remains the same. Bulls will create an opportunity above the 135.74 level, hence it is important to leave the consolidation area and update the extremum (136.56). On the other hand, the bears remain at the 135.74 region and retained a slight advantage in the forces. Furthermore, it is important for them to take hold of the 135.33 (Tenkan H4 + Kijun H1) today and move down to the lower boundary of the H4 cloud (134.68). Thereafter, the main significance is the overcoming of the support for higher timeframes (134.56 + 134.09-14).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română