The European currency rose against the US dollar after the press conference of the president of the European Central Bank, Mario Draghi, on which he started with caution, but noted good points in the eurozone economy.

However, the demand for risky assets in the area of new annual highs did not receive serious support, which led to quick fixation of profits and the sale of the euro to the closure of the North American session on Thursday.

During the speech, the ECB President noted that the incoming information confirms strong economic growth, and the cyclical moment strengthens the confidence that inflation will reach the target level. Draghi expects that in the future, interest rates will not be so low.

As for inflation, the head of the ECB is concerned that domestic price pressure remains restrained, as there are no convincing signs of a stable upward trend in consumer prices.

Skeptics found the negative in Draghi's statement that the volatility of the foreign exchange market is a source of uncertainty and requires tracking. Let me remind you that conversations around verbal interventions from the ECB went as early as this year, as the high rate of the euro could have a negative impact on the recovery of the European economy.

The ECB President also noted that serious monetary stimulus is still needed, and current monetary policy continues to support domestic demand, which keeps the risks for the prospects for economic growth fairly balanced.

The data on the number of Americans who filed initial applications for unemployment benefits slightly influenced the rate of the US dollar.

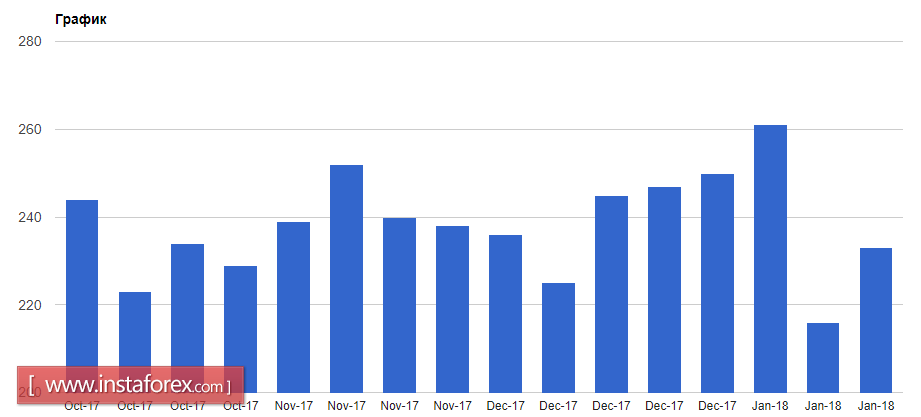

According to the report of the US Department of Labor, the number of initial applications for unemployment benefits for the week from 14 to 20 January increased by 17,000 compared to the previous week and amounted to 233,000. The economists predicted that the number of applications will be 237,000.

The Canadian dollar also fell by the end of the day against the US dollar after weak data on retail trade growth in Canada in November 2017.

According to the report, retail sales in November rose by only 0.2% compared to October and amounted to 50.06 billion Canadian dollars. This happened due to a drop in activity on sales of new cars. The economists had expected that growth in November would be 0.8%. In comparison with the same period of the previous year, sales in November increased by 6.5%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română