The US dollar began to rise against the main currencies on a wave of several factors. On one hand, there is the noticeable technical oversoldness as an objective. On the other hand, the market is waiting for new signals that could confirm the movement from soft to hard of the monetary policy exchange rates from the central banks of economically developed countries.

If everything is clear with the dollar being technically oversold, then in regard to the reality of changing monetary rates, for example in the ECB and the Central Bank of Japan, is not all so obvious. The recent meetings of these regulators have shown that they are very cautious about this. Knowing perfectly well that the growth of the economy, say, in the euro area is clear to the ECB. At the same time, it sees that the inflationary processes are stalled and markedly skewed. The economy is growing but demand among the population against a background of a strong debt burden remains weak. This, in the long run, may lead to overheating of the economy.

We have previously pointed out that economic growth in countries such as the US or the euro area is not due to a strong growth in demand but because of incentive measures. This is an end that could again plunge the euro area or the States into a crisis. This frightens the ECB and some other countries, making the central bank very cautious about stopping incentive measures. Simply put, they are afraid that with the printing press stopping from economic growth, there will be nothing left.

However, we need to go back to the currency market. In order for the euro and other major currencies traded against it to continue to grow, the dollar should remain weak and new drivers should arrive to grow these currencies. However, these drivers are not yet available. There could be an increase in inflationary pressures at least in the eurozone, Japan, and a number of other countries. So, the correction towards a local strengthening of the dollar may continue. Despite this, we do not expect the continuation of its global growth, at least in the near future.

Forecast of the day:

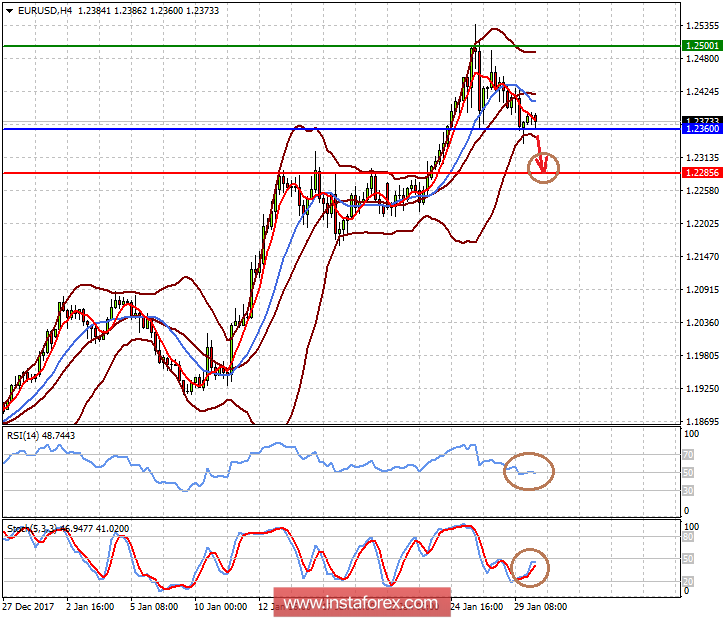

The EURUSD pair may continue its downward correction if the eurozone's GDP data are worse than expected. On this wave, a price decline below 1.2360 could lead to a decrease to 1.2285.

The GBPUSD pair remains under pressure due to the break in the negotiation process for Britain's withdrawal from the EU. We can assume that the local fall of the pair will most likely continue after falling below the level of 1.4000 to 1.3900.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română