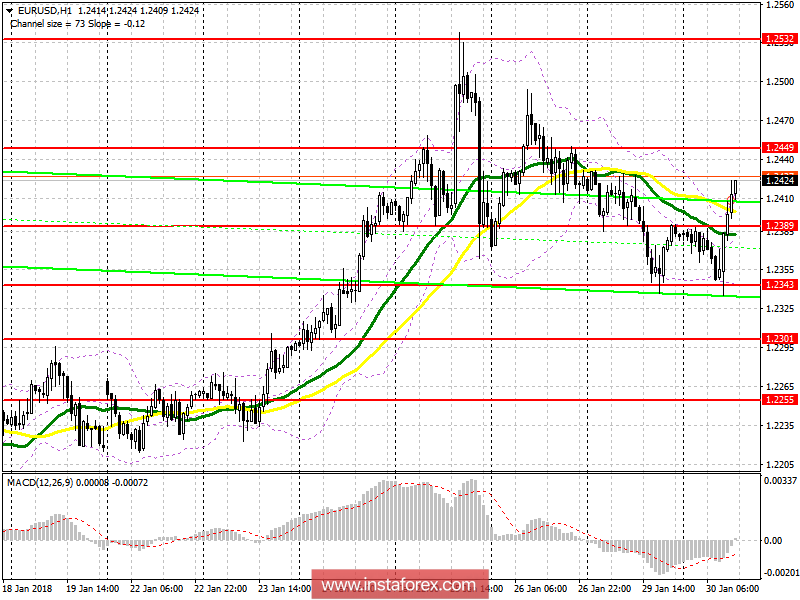

EUR / USD

To open long positions for EUR / USD, it is required:

The morning scenario has worked itself out and now, the buyers are striving to the of level 1.2449. Most likely, there will be a small correction to the support area of 1.2389, where you can again consider buying the euro. The repeated test of 1.2449 may lead to the breakdown of this level and the continuation of the pair EUR / USD growth to the area of 1.2532, where I recommend fixing the profit.

To open short positions for EUR / USD, it is required:

The sellers will try to work at the level of 1.2449, and the formation of a false breakout will be an additional signal for the opening of short positions with a view of returning to the level of 1.2389, where I recommend fixing profit. In the case of a breakout of 1.2449, I recommend that you go back to a rebound from sales at 1.2532.

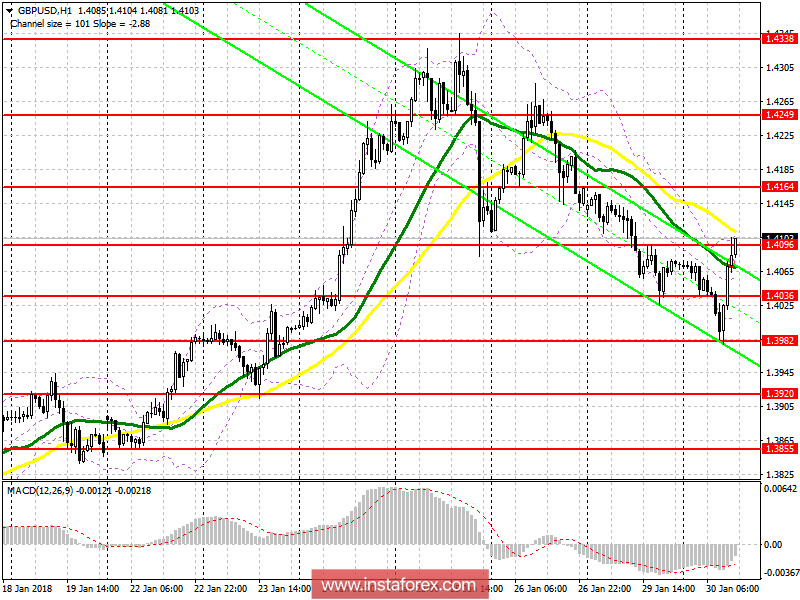

GBP / USD

To open long positions for GBP / USD, it is required:

The break and consolidation above the level of 1.4096 opens a good opportunity for further pound growth with an update of 1.4164 and exit at 1.4249, where I recommend fixing the profit. In the event of an unsuccessful fastening above the level of 1.4096, the best way to buy GBP / USD is to return to a rebound of 1.4036.

To open short positions for GBP / USD, it is required:

Sellers have tried to limit the growth above the level of 1.4096, but so far, the demand for the pound has remained. In this scenario, it is best to look for short positions for a rebound from 1.4164, or even higher, around 1.4249. If the pound returned to the level of 1.4096, you can also search for sales in order to update to the level of 1.4036.

Indicators

MA (average sliding) 50 days - yellow

MA (middle sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română