EUR / USD, GBP / USD.

On Tuesday afternoon, investors were optimistic about buying the single European currency due to the eurozone's GDP data for the 4th quarter. The economy for this period showed an increase of 0.6%, as expected, but the growth was revised to increase from 0.6% to 0.7% over the previous period.

In the previous period, there was an increase from 2.6% to 2.8% YoY, the growth for the 4th quarter is expected at 2.7% YoY. In the United Kingdom, the number of issued mortgages for December declined from 65 thousand to 61 thousand in November, while the expected increase is 66 thousand, but the amount of mortgage lending amounted to 3.68 billion pounds against expectations of 3.45 billion. While the volume of general lending to individuals in November amounted to 5.2 billion pounds against the forecast of 4.8 billion pounds. With some pressure on the data, it is possible to accept the data as neutral-optimistic, which the investors did.

According to the United States, the good data came out but the decline in the stock market's dampened investors' desire for risk and the counter dollar currencies fell back. The Conference Board's consumer confidence index rose from 123.1 to 125.4, S&P / Case-Shiller home price index in the top 20 cities grew by 6.4% YoY against expectations of 6.3% Yoy. The speech of US President Donald Trump in Congress was under the traditional slogans of America's prosperity and aimed at pushing the new NAFTA agreement.

In the business media, the inconsistency of the documented dollar weakening is widely discussed, since there are many reasons why the dollar should not weaken and the one of the main reason is the discrepancy in the Fed's interest rates and the ECB. Based on opinions, the reason lies in the political divergence in the United States. Since April last year, the actual contraction of the Fed's balance sheet is from $ 4.479 trillion to the current $ 4.441 trillion did not overlap, as expected last autumn, with the delay in the form of new hiring due to the acceptance of the new ceiling for the national debt and budget. Markets receive excess liquidity, which is directed to risky operations in the stock market. This is because the monthly growth of Dow Jones in January set a record for the last 30 years, which has pulled the markets into general risky correlations. In case that this assumption is true, the markets will not grow longer until the moment when the US will try again to pump out excess, along with the dollar liquidity for infrastructure reforms from the external markets.

Today, the euro area is expected to be moderately optimistic. The forecast for the base CPI for January is 1.0% YoY versus 0.9% YoY a month earlier, while the total CPI may fall from 1.4% YoY to 1.3% YoY. The number of unemployed in Germany for January may fall by 20 thousand, while the unemployment rate in the euro area is forecasted to remain unchanged at 8.7%.

In the United States, the number new jobs in the private sector from ADP for January is projected at 191 thousand against 250 thousand in December. Unfinished sales in the US secondary real estate market for December are expected to increase by 0.5%, while business activity in Chicago's manufacturing sector for January is projected to decrease from 67.6 to 64.3. At 7:00 PM London time, FOMC's decision on the basic interest rate will be published with a brief accompanying statement.

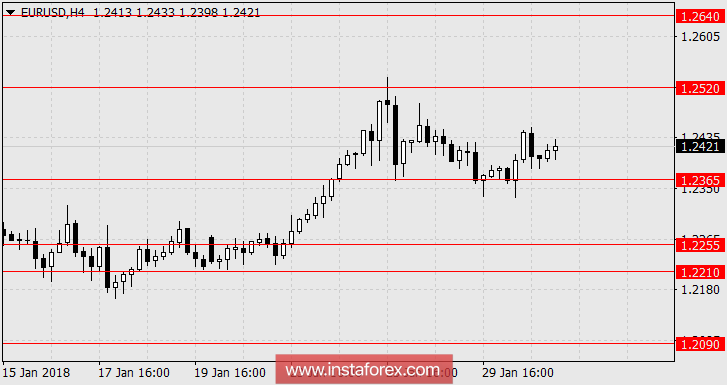

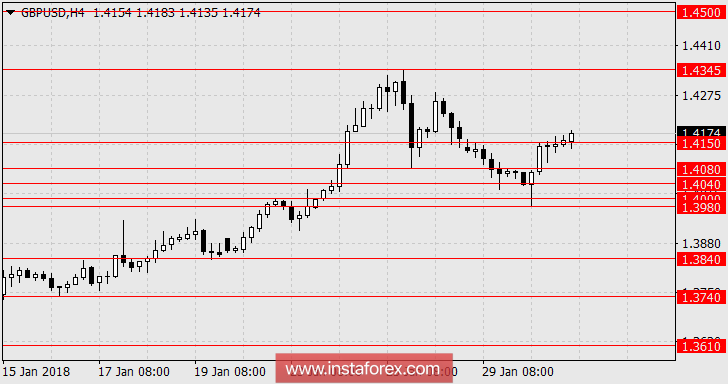

Thus, if investors' expectations regarding the "hawkish" accompanying statement are not confirmed, the euro and pound will continue to grow. The composition of the FOMC voting members for this year had increased by two "hawks" during the rotation (Williams, Mester), but it cannot be considered yet, that we will see the effect at the first meeting.

The main scenario that we can consider is the growth of the euro to 1.2640, while the pound rises to 1.4345, further to 1.4500. For the alternative, we consider the euro correction expanding to 1.2255, and the British pound towards the range of 1.4040 / 80 or 1.3980-1.4000.

AUD / USD.

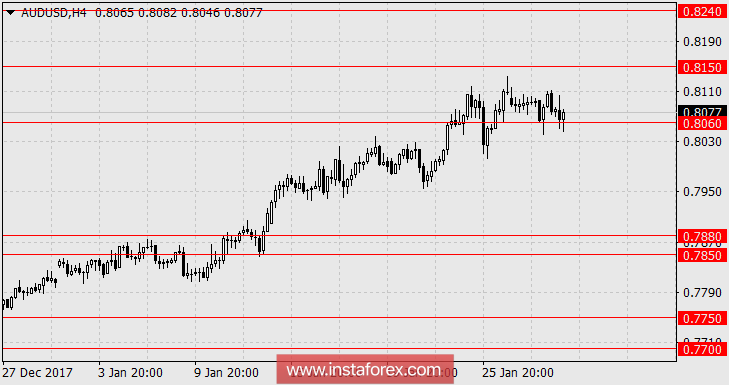

Yesterday, the Australian currency trades in a narrow range in anticipation of the possible change in the accompanying statement of the Fed during the FOMC meeting The business confidence index NAB for December increased from 7 (revised from 6) to 11. The forecast was 12, but the current is quite optimistic. Today, Australian economic data also came out weaker than expected, but there has been an increase in the previous periods. The consumer price index for the fourth quarter increased from 1.8% YoY to 1.9% YoY, with a 2.0% YoY expectation, while the quarterly increase was 0.6% against expectations of 0.7%. The weighted average CPI added 0.4% quarter on quarter. The private sector lending in December increased by 0.3% against the forecast of 0.5%. From the investor's point of view, there is nothing negative about the published data, the "Australian" stayed at the lower border of the range 0.8060-08150.

On the other hand, Chinese business activity indicators for the current month came out mixed. Manufacturing PMI fell from 51.6 to 51.3 while expecting for 51.5, non-productive PMI increased from 55.0 to 55.3 with the forecast remain unchanged. The reaction of the Chinese investors to the data was optimistic, as the stock index of China A50 grows by 1.50%. Accordingly, Australian investors are in a good mood, since the S & P / ASX 200 rose to 0.28%.

The Australian currency holds against the pressure of commodity markets, which indicates the attention of investors to the US dollar policy. Oil fell to 0.9%, iron ore lost 1.8%, and copper reduced by -0.5%. We are looking forward to the growth of AUD / USD pair to 0.8240. In that event, the Fed does have aggressive notes in the accompanying statement of the FOMC, and the price may go to a flat level below 0.8060 until the recovery of risk appetites.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română