The US dollar made an attempt to recover against the European currency in the afternoon on Tuesday, January 30 but the demand for risky assets led to the resumption of the euro's growth which is already in the course of today's Asian session.

Many traders and investors put on a good report on inflation in the euro area, which will be published today in the morning. It will give an upward impulse to the European currency in order to update the monthly and annual highs.

Yesterday, it became known that the consumer confidence index in the US rose in January after a decline in December last year.

According to the Conference Board, the index rose to 125.4 points in January against 123.1 points in December. Economists had expected that the index would be at 123.0 points in January.

Housing prices in the US continue to rise. Such data was published yesterday by Case-Shiller. According to the report, the national housing price index in November 2017 increased by 6.2% compared to the same period of the previous year after rising by 6.1% in October. The index for 10 megacities increased by 6.1% compared to the same period of the previous year. The index for 20 megacities rose by 6.4%. Economists had expected the index for 20 megacities in November to show growth of 6.3%.

Today, all the attention of traders and investors in the first half of the day will be focused on inflation data in the euro area. Meanwhile, by the middle of the North American session, the US Federal Reserve decision on interest rates and accompanying statements will be published.

As for the technical picture of EURUSD, a break above 1.2450 will lead to continued growth in risk assets with the update to 1.2500 and 1.2560. However, for a larger upward trend, good indicators for inflationary growth in the eurozone are needed.

Today, the British pound strengthened its position against the US dollar after data that consumer confidence in the UK in January 2018 increased as the British are more optimistic about their finances and the economy.

According to the report of the research company Gfk, the index of consumer confidence in January increased by 4 points and amounted to -9 points.

Despite the fact that consumer prices in Australia in the 4th quarter rose, the Australian dollar fell against the US dollar. This happened because inflation, despite its growth, was worse than economists' forecasts.

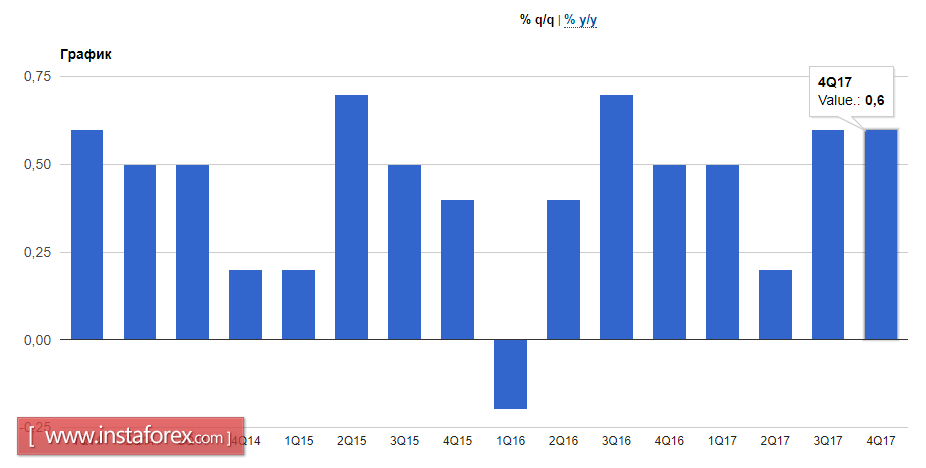

According to the Australian Bureau of Statistics, the consumer price index increased by 0.6% compared to the previous quarter and by 1.9% compared to the same quarter of the previous year. Economists predicted a quarterly growth in the consumer price index by 0.7% and an annual growth of 2.0%.

The basic consumer price index, which does not take into account the volatile categories of goods, grew by 0.4% compared to the third quarter while economists had forecast growth of 0.5%. Compared to the same period last year, the base index rose by 1.9%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română