Despite the good figures for consumer confidence in New Zealand, the New Zealand dollar fell strongly against the US dollar in the first half of the day. Traders closed long positions before the release of important US data.

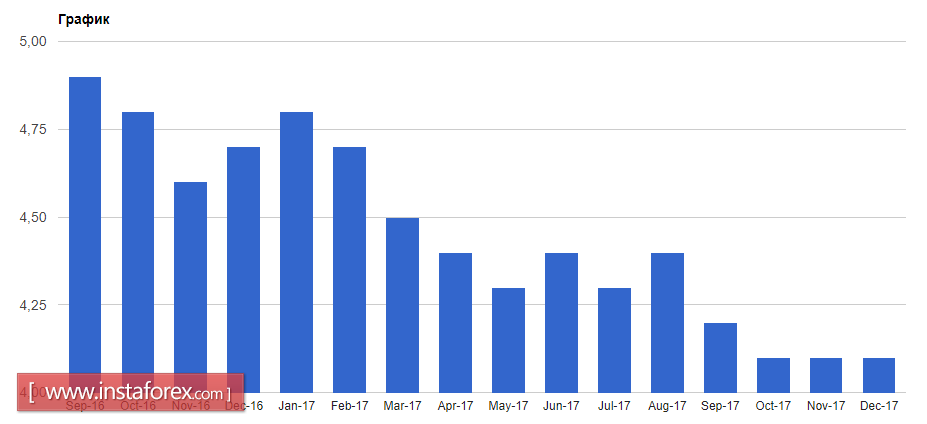

According to the report of ANZ-Roy Morgan, the consumer confidence index in New Zealand in January this year rose to 126.9 points from 121.8 points in December. Despite this, many analysts pay attention to the fact that even as a result of the growth in January the index is still below the highs that were achieved in September last year, which only indicates a recovery of consumer confidence, which was due to the stabilization of the housing market and the reduction of uncertainty after the elections in the country.

As for the technical picture of the NZDUSD pair, after the large growth that has been observed since November last year, the current decline from the highs from January 24 is only a small correction, while for a larger breakthrough in the New Zealand dollar, a much larger drop in the short term will be required. Good levels of support are seen in the area of 0.7265 and 0.7215. In the event of a decline in the trading instrument in this range, it is recommended to consider long positions. A breakout of 0.7410 will lead to a further upward trend with the update of 0.7515 and 0.7565.

The US dollar did not receive support even after it became known yesterday that the representatives of the Republican Party in the US Congress discussed the possibility of extending government funding by the end of March this year. It was on 22 and 23 March. Voting on this issue will be held next week.

It should be noted that the term of financing expires on February 9. Last time, it was not possible to quickly reach an agreement, in connection with which the work of the government was suspended for three days. While the long-term budget will not be coordinated, the problem of this kind will continue to exist, which will necessarily negatively affect the prices of the US dollar.

As for the technical picture of the EURUSD pair, only a strong break above 1.2510 will result in the further growth of risky assets, with the update of new monthly highs around 1.2560 and 1.2600, where it will be possible to observe a surge in volume against the background of fixing long positions. In the case of good data on the US labor market, the output of which is scheduled for this afternoon, the pressure on the euro may increase, and a break below 1.2470 will lead to a sell-off and a decline in the trading instrument in areas of 1.2430 and 1.2390.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română