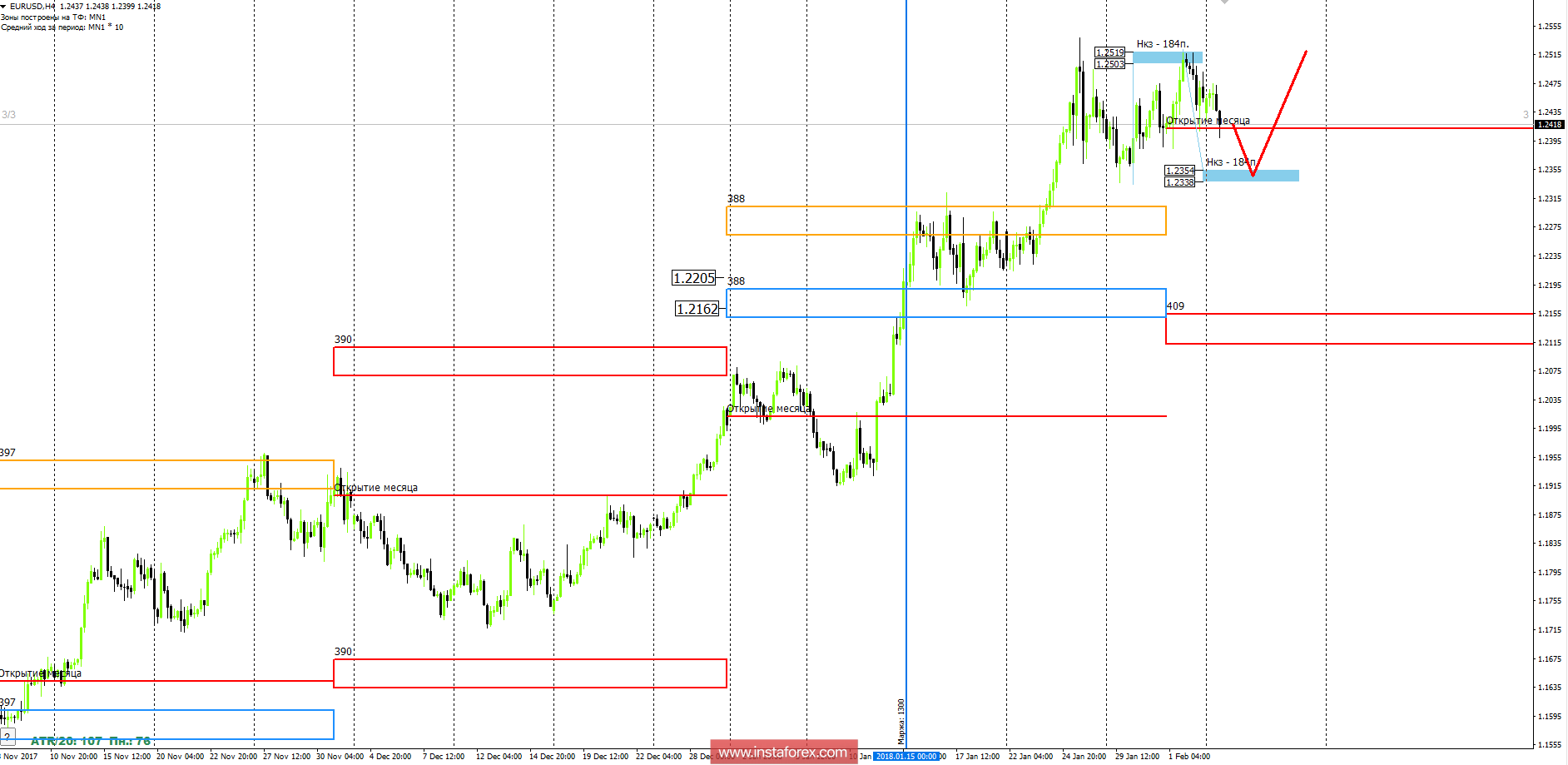

The second week continues the formation of the medium-term accumulation zone. The closest boundaries are the extremes of last week. The upward trend remains a priority in the medium term.

Medium-term plan.

The formation of the medium-term accumulation zone obliges to seek opportunities for both purchases and sales. It is important to understand that as long as the pair is traded above the weekly short-term fault of 1.2354-1.2338, the medium-term momentum remains bullish. To disrupt the upward movement, it would be necessary to close one of the American sessions below the level of 1.2338. This will allow us to consider further depreciation towards the monthly short-term review of February. The continued growth of the pair suggests a high probability of renewing the annual maximum in the short term.

The alternative model will develop if the pair can stay above the opening level of trading in February. This will allow you to consider purchases when forming the appropriate pattern.

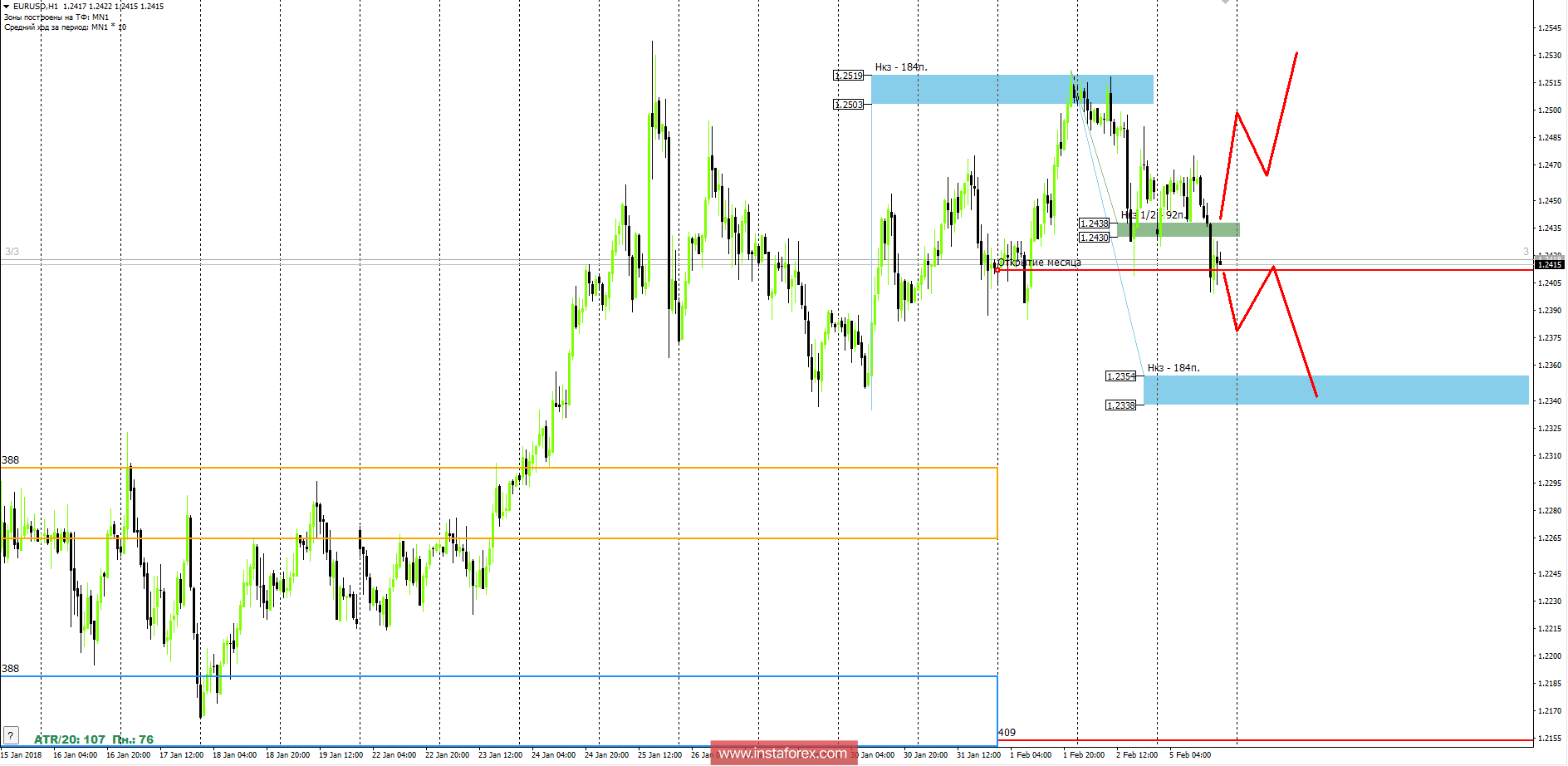

Intraday plan.

Today, there was a breakdown of the main support zone for the NCP 1/2 1.2438-1.2430. If today's US session closes below the level of 1.2430, the downward movement will become a priority in the short term. The goal of the fall will be a weekly short-term fault of 1.2354-1.2338. The movement in the specified range will allow you to search for sales tomorrow, with a probability of working out 70%. If today the pair can stay above the level of 1.2438 by the close of trading, then it will allow to search for purchases, whose aim will be to update the February maximum.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română