EUR / USD, GBP / USD.

On Monday, a hurricane suddenly burst into the markets. For some unknown reasons, the US stock market collapsed by 4.10% (S & P500), which is the largest daily decline since 2012, while the Dow Jones index closed the day by 4.60% decline, and gained -6.3% as of this writing. The government bond yields for 5-year securities had fallen down, the decline occurred from 2.59% to 2.42%, while the 10-year is down from 2.84% to 2.72%. With the increasing fears that crisis has begun, investors started to buy gold and the growth of this precious metal was 0.6%. The Japanese yen known as the "safe haven", lost 106 points, while the euro lost 88 points, and the British pound reduced by 155 points. This morning, the market panic continues and news agencies cannot identify the reason for such fears. The news agency, CNBC has pointed out that the reason behind this commotion is the psychological factors of investors. Ironically, Bloomberg published an extensive article on the same day about the strong growth of the economy, which is driven by the growth of government bonds, while US President Donald Trump delivered a speech regarding the successes of his administration in the economic sphere.

Pressure on the markets began gradually. The business activity index in the service sector of Great Britain for January showed a decrease from 54.2 to 53.0, and retail sales of the euro area for the December estimate fell by 1.1% which is at the forecast level. In the United States, ISM Non-Manufacturing PMI rose from 55.9 to 59.9 in January and during that time, the markets had gained substantial acceleration.

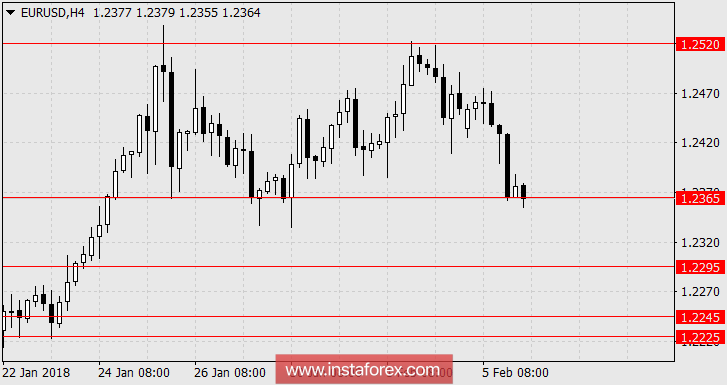

Now, the question is when this crackdown stop and fears subside, the reasons remained unclear, then the trend may continue for another 2-3 days. Today, the December volume of industrial orders in Germany will be released with the forecast of 0.6% against -0.4% in November. The US trade balance for December will be published, showing a forecast of -52.1 billion dollars against -50.5 billion in the previous month. Forecasts for indicators are generally neutral. We are expecting for the euro at 1.2295, and the pound sterling at 1.3840.

AUD / USD.

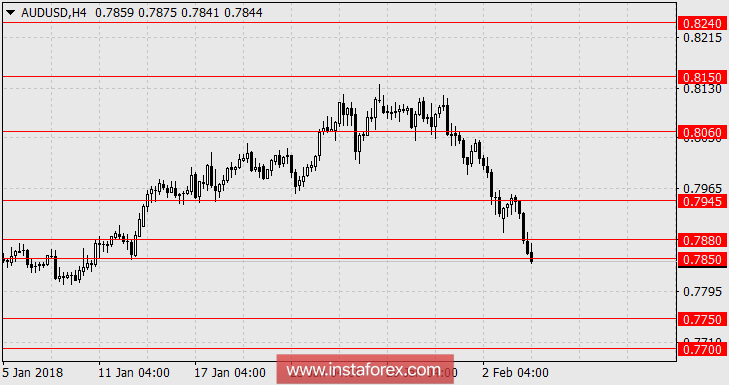

In the light of the panic for the Australian dollar yesterday, nothing has changed with the situation. The bearish trend since January 29 continued. But, the "Australian" received another blow today from the national economic indicators. Retail sales in December decreased by 0.5% against the forecast of -0.2%. The trade balance of the same month showed a balance of -1.36 billion dollars against the forecast of 0.25 billion dollars. Today, the RBA decided to keep the rate unchanged and published a neutral accompanying statement. The markets retained its adopted strategy without such adjustment to quietly sell the Australian dollar in the light of the US dollar strengthening amidst that panic mood and the strengthening trend of declining commodities. Oil has declined in price by 2.1%, and non-ferrous metals are losing from 0.3% to 2.4%. Contrarily, the iron ore managed to expand by 0.95%, although in general, its price fell to the $ 73.64 level earlier this year.

In Asian markets, the turmoil is more or less milder than in the US yesterday. The Japanese Nikkei225 index falls by 6.45% (!), the Australian S & P / ASX200 came in at -3.42%, China A50 at -2.19%, Indonesian JKSE was -2.17%, and Indian Nifty50 at -2.84%. We are expecting for the commodity-linked pair AUD / USD at 0.7750, then for 0.7700.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română