Yesterday, the speech of the Minister of Finance in the US did not significantly affect the quotations of the US dollar, since it was mainly due to the recent collapse of the US stock market.

US Treasury Secretary Mnuchin said that the current volatility of the market does not reflect the problems of financial stability, since the fundamental indicators are quite strong. The fall of the stock market, according to Mnuchin, reflects the usual market correction, although large, and therefore, he is not particularly concerned about the current market volatility.

Mnuchin changed his attitude to the US dollar, after recent criticism from the administration of the White House, including US President Donald Trump. This time, the Minister of Finance announced that a strong dollar meets US interests in the long term. Mnuchin also appealed to the Congress to raise the limit of the national debt in any way he wants.

As for the technical picture of the EUR / USD pair, we see how buyers are resisting the current downward trend, and every time after updating the lows, they quickly buy back the European currency, which will allow us to at least count on preserving trade in a wide lateral channel with the boundaries 1.2350-1.2470 in short term.

The New Zealand dollar rose strongly against the US dollar today in the Asian session after it became known that the labor market continues to show good performance.

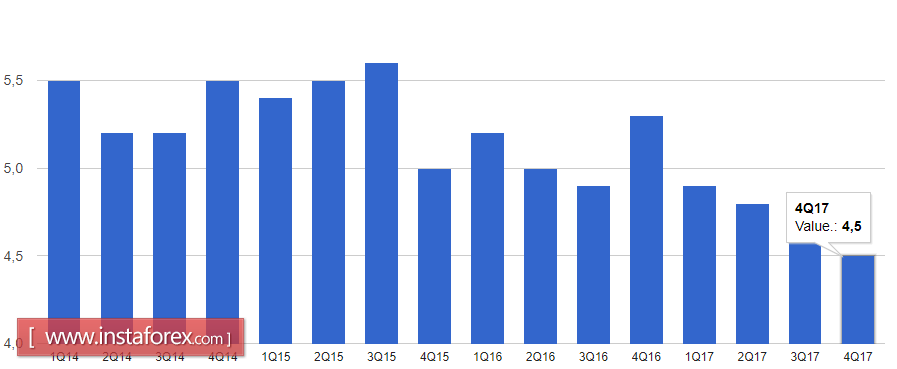

According to a report by the National Bureau of Statistics of New Zealand, the unemployment rate in New Zealand in the fourth quarter of 2017 fell to 4.5% compared with 4.6% in the third quarter. Economists predicted that the unemployment rate in the 4th quarter will be 4.6%. The share of economically active population was 71%. The number of employed in New Zealand increased by 3.7% compared to the same period of the previous year after rising by 0.5% in the previous three months.

The bureau noticed that, despite the sharp drop in the unemployment rate, still 340,000 people are working with part-time employment, which is why this indicator should also be adjusted for the better.

As for the technical picture of NZD / USD, the buyers managed to work out the support in the area of 0.7260, and now rushed to the first intermediate level of resistance 0.7360, the breakthrough of which will lead to the area of 0.7405 and 0.7450.

Yesterday, the quotations of oil rose slightly after data that the oil reserves fell. According to the report of the American Institute of Oil, inventories for the week of January 27 to February 2 decreased by 1.05 million barrels.

Today, a more important report is expected from the US Department of Energy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română