Today, everything will revolve around data on producer prices in the US, whose growth rates should slow from 2.6% to 2.5%. Given the sharp decline in retail sales growth rates, as well as the continued growth of commercial inventories, it is suspected that the growth in producer prices will decline more. Thus, the reasons for a rebound in the dollar simply are not feasible. Another thing, the dollar is oversold which limited its potential for weakening.

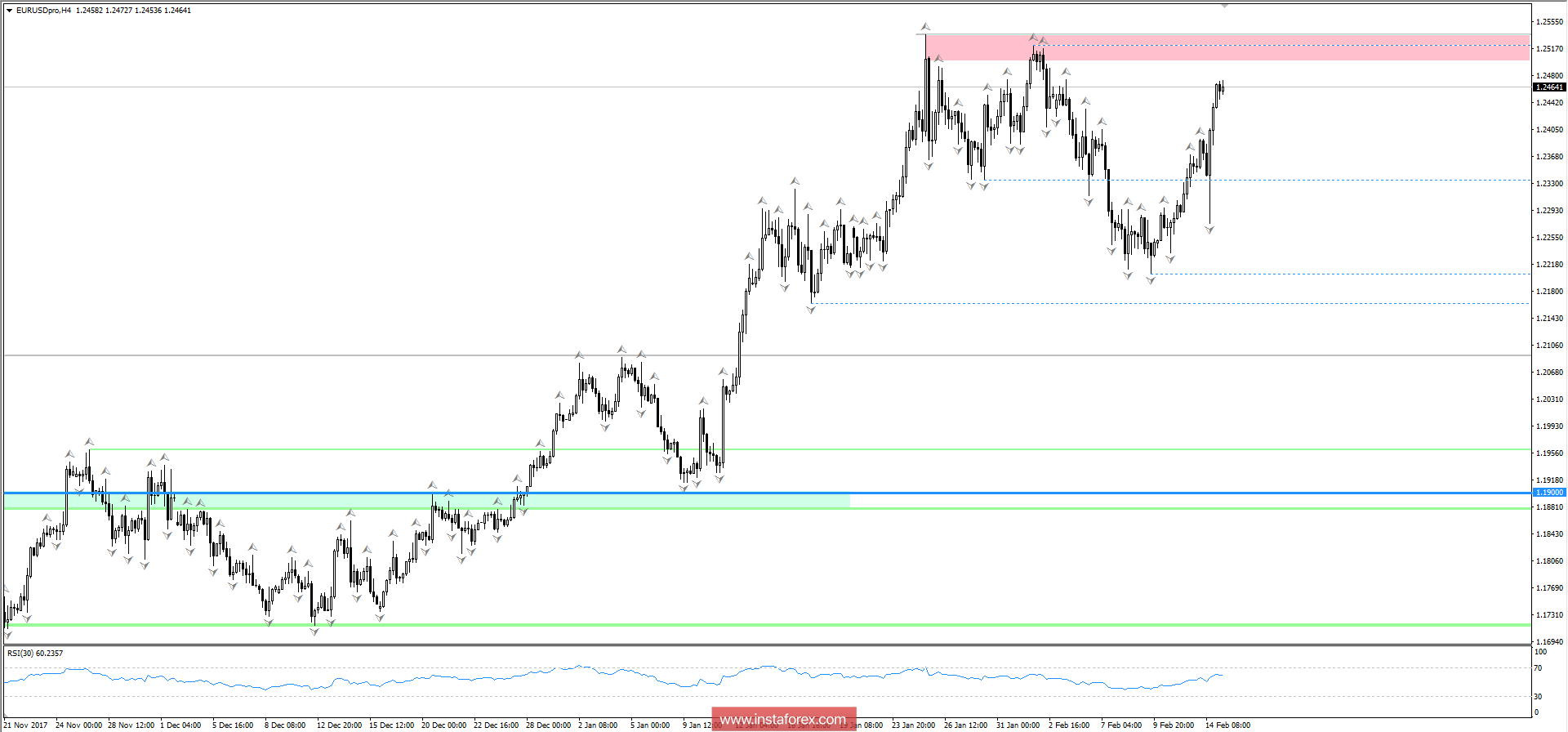

The euro against the dollar major pair showed a high volatility, strengthening the euro by almost 200 points. Probably, the bulls are already approaching the stage of overheating which is already at the value of 1.2500/1.2530, where the resistance level is located. Short positions are expected to stop appearing.

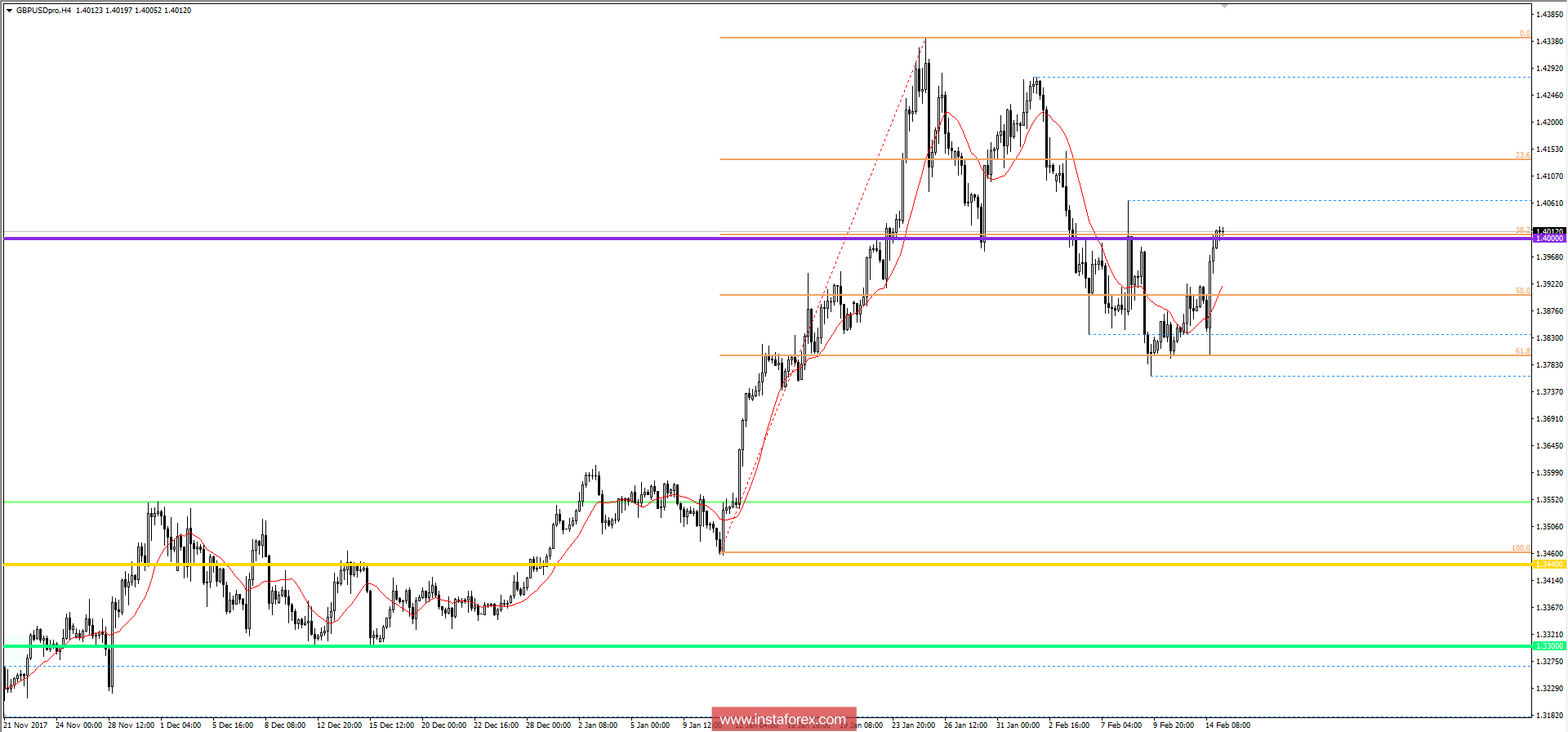

The pound against the dollar major pair, similar to its counterpart, showed growth and returned the psychological level of 1.4000. Now we see an interference within the level and the formation of two-digit candles like "Doji". It is possible to assume further waver within the framework of 1.3990/1.4050, with an analysis of breakdown points in the boundaries.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română