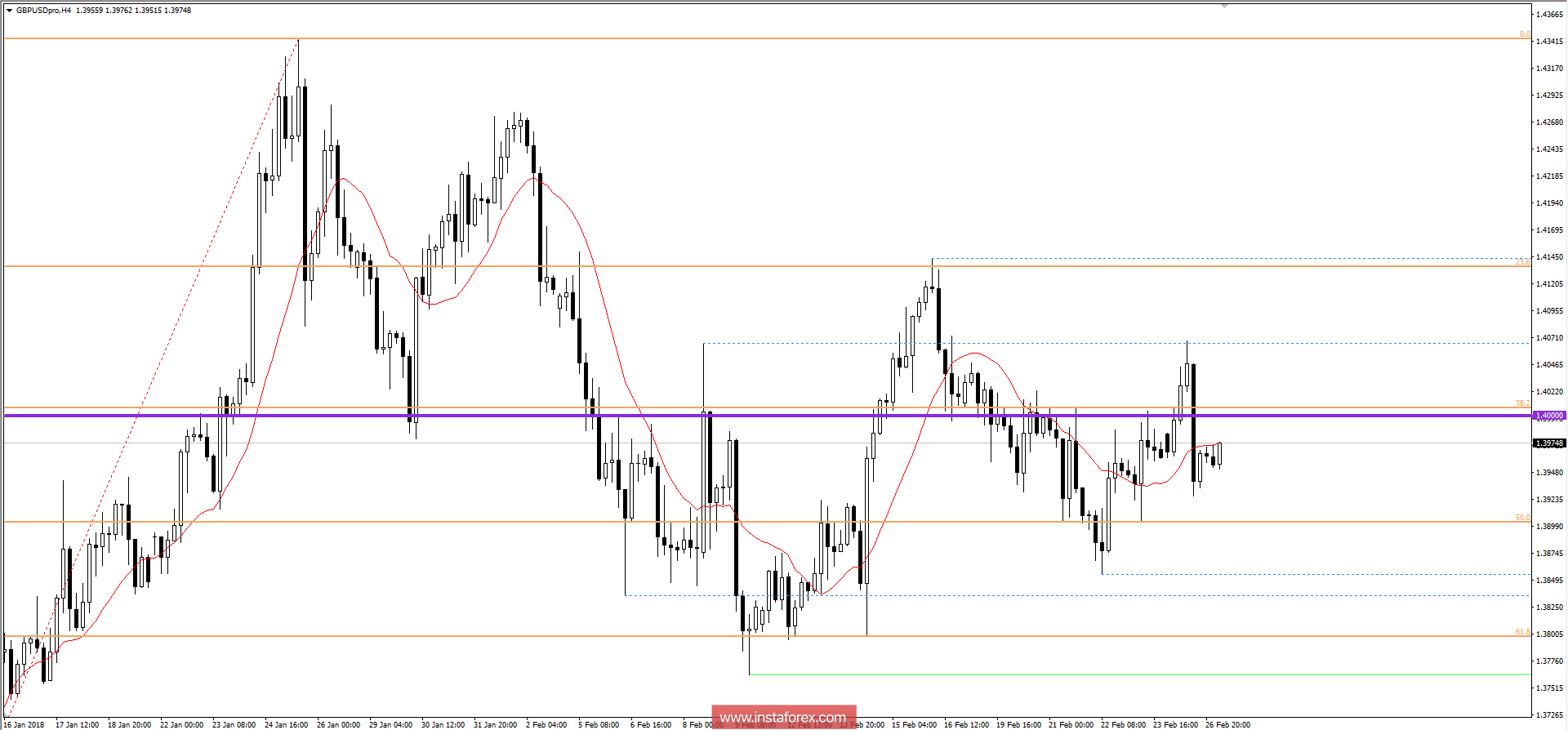

After the yesterday's decline, the pound itself suggests a rebound, for which only an excuse is needed. Such an occasion today will be the American statistics. Thus, orders for durable goods may be reduced by 2.0%, and such a significant decrease once again points to the growing risks of the crisis of overproduction, as orders are reduced due to overstocking of warehouses. Also, the growth rate of housing prices should slow from 6.4% to 6.3%, and this indicates a growing potential for reducing inflation.

The pound / dollar currency pair after the impulse movement of 100 points felt a temporary support in the value of 1.3930, where it slowed down the movement and as a result, fell back. Now, there is a temporary bump, with varying bullish interest. It is possible to assume further pulling of the quotation to the level of 1.4000 / 1.4015, where only after fixing it is worth considering further variations.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română