Forecast in medium period (2 days - 4 days):

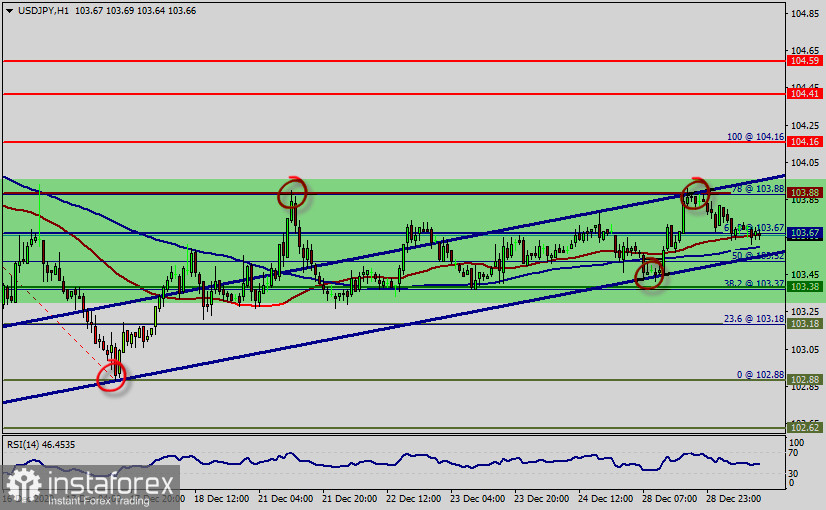

- According to the previous events the price is expected to remain between 102.88 and 104.59 levels.

- Buy-deals are recommended above 103.38 with the first target seen at 103.88. The movement is likely to resume to the point 104.16 and further to the point 104.59.

- The descending movement is likely to begin from the level 104.59 with 103.87 and 103.00 seen as targets.

Outlook :

The USD/JPY pair retains its bearish position. In the 1-hour chart, it met sellers around its 100 SMA and 50 SMA, which heads firmly lower at around 103.38. The USD/JPY pair is still staying in long term falling channel that started back in 104.16 since Decmeber 14, 2020). Hence, there is no clear indication of trend reversal yet. The USD/JPY pair has broken support at the level of 103.67 which acts as a resistance now. According to the previous events, the USD/JPY pair is still moving between the levels of 103.67 and 102.88. Therefore, we expect a range of 79 pips in coming hours. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Thus, the price spot of 103.67 remains a significant resistance zone. The price of 103.67 coincided with a golden ratio (61.8% of Fibonacci), which is expected to act as a major resistance today. Consequently, there is a possibility that the USD/JPY pair will move downside. The structure of a fall does not look corrective. In order to indicate a bearish opportunity below 103.67, sell below 1.1239 with the first target at 103.18. Since the trend is below the 61.8% Fibonacci level, the market is still in a downtrend. Overall, we still prefer the bearish scenario. The trend is still bearish as long as the level of 103.67 is not broken From this point, we expect the USD/JPY pair to continue moving in the bearish trend from the support level of 103.67 towards the target level of 103.18. If the pair succeeds in passing through the level of 103.18, the market will sign the bearish opportunity below the level of 103.18 so as to reach the second target at 102.88 (low wave, bottom). In the same time frame, resistance is seen at the levels of 103.88 and 103.67. The stop loss should always be taken into account for that it will be reasonable to set your stop loss at the level of 104.16.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română