USD / JPY

Yesterday, the Japanese yen lost more than 60 points but was decisively pulled from the bottoms formally on the growth of US stock indices in the last trading hours. As a result of the day, S & P500 closed the day in the red at 0.05%, while the Dow Jones lost even more by -0.33%, but the Nasdaq technology gained 0.33%. The small-cap companies Russell2000 Index shot up by 0.83%. This is a good sign of further growth in the major US indices.

The index of Japan's leading economic indicators for January fell to 104.8% from 107.4%, and the forecast for a more moderate decline to 106.5%. This morning, investors were pleased with the GDP and indicators of Japan balance of payments. January Current Account adjusted for seasonal fluctuations amounted to 2.02 trillion yen against the forecast of 1.76 trillion and 1.68 trillion yen in December, it was revised to an increase of 1.48 trillion. Current Account, excluding seasonal fluctuations, has dropped from 0.797 trillion yen to 0.607 trillion yen. However, the positive sign shows that the consensus forecast was expected to decline to 0.310 trillion yen.

The final estimate of the GDP for the fourth quarter increased from 0.1% to 0.4% in comparison with the revised forecast to 0.2%. On an annualized basis, the GDP rose to 1.6% against expectations of 0.9% YoY. The consumer spending in the fourth quarter increased by 0.5%, which corresponds to growth in the third quarter.

China was also satisfied for this day, as in the balance of trade. The increase in exports was very quick, from 11.1% YoY to 44.5% YoY. At the same time, the Japanese stock index Nikkei225 adds 0.46%, and Chinese China A50 by 0.93%

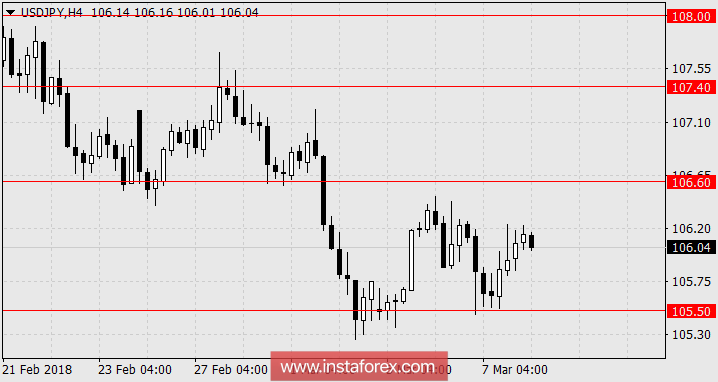

We are expecting for the yen to rise to 107.40.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română