To open long positions for EURUSD, you need:

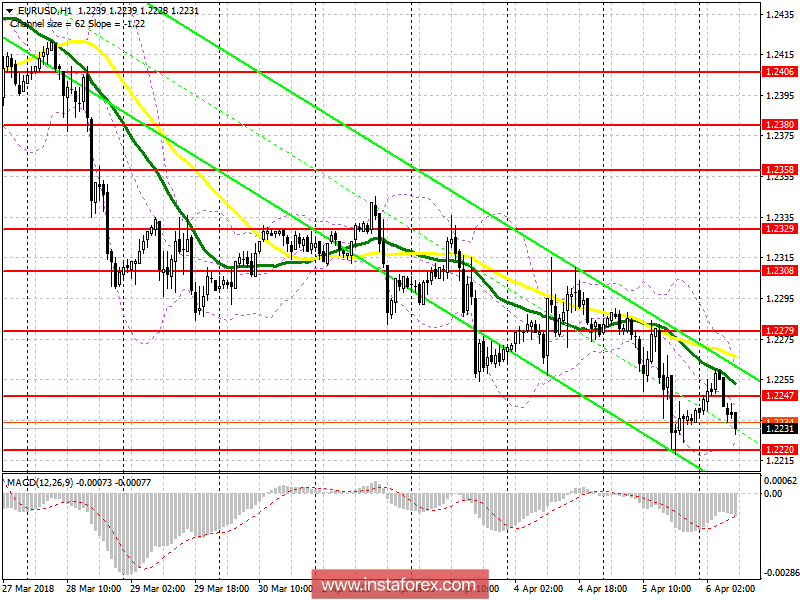

It is important to focus attention on labor market data in the United States. On buying in the first half of the day, we can count on the formation of a false breakdown at 1.2220. This is with confirmation of the divergence on the MACD indicator. The breakdown and consolidation above the level of 1.2247 opens yesterday's highs around 1.2279 and 1.2308, where it is recommended to lock in profits.

To open short positions for EURUSD, you need:

The next formation of a false breakdown and a return to the level of 1.2247 will lead to a new wave of sales of the European currency with the main goal of reducing to the support level of 1.2220. Only a consolidation below this level following the release of important fundamental data will allow us to count on the further decline of the euro in the areas of 1.2190 and 1.2158.

Indicator description:

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română