GBP / JPY pair

Higher timeframes

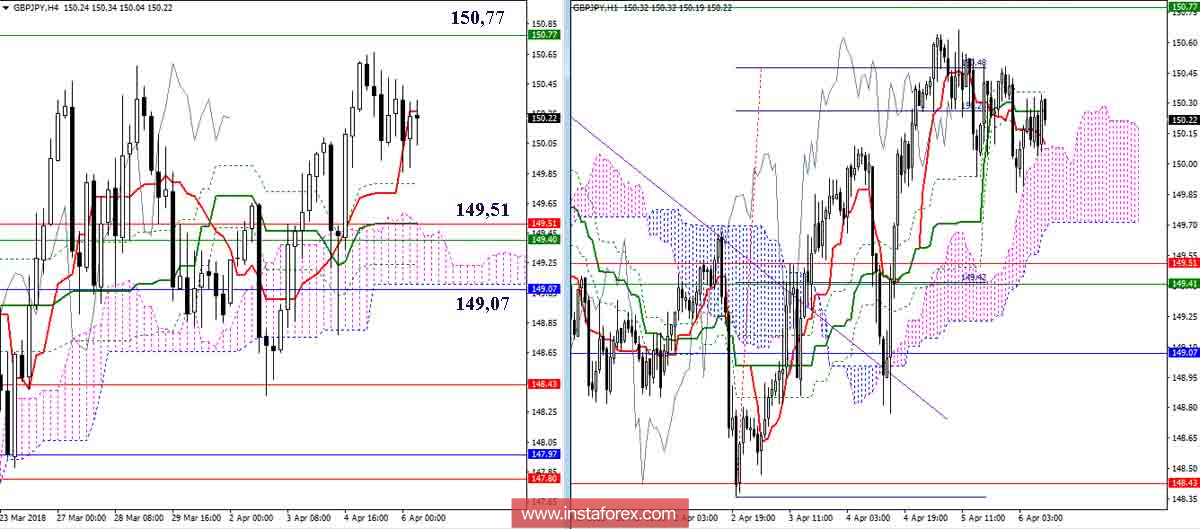

In yesterday's movement, there are no significant adjustments to the previously announced conclusions and expectations. Today, we close the week. The minimal upper shadow of the weekly candle will serve as an indicator of the preservation of bullish plans and talk about the possible weakness of the acting resistances (weekly Kijun 150.77 + day Senkou Span B 151.29). Closing under the nearest support levels (the lower boundary of the day cloud + daytime Tenkan 149.51 + weekly Fibo Kijun 149.40) can serve as a signal to the beginning of the formation of rebound from the supported supports.

H4 - H1

The situation has not undergone drastic changes. We observe a slight decrease on the background of inhibition when meeting the most important zone of resistance (150.77 - 151.29). Going beyond the limits of resistance will open up new prospects for players to improve. The breakdown of the nearest support levels (149.51-07) and reliable consolidation below will change the balance of forces formed at the lower halves and form downward benchmarks (targets for the breakdown of H4- and H1- clouds). At the closing of the week, for players to rise it is desirable to maintain their positions and not go down under support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română