GBP/JPY

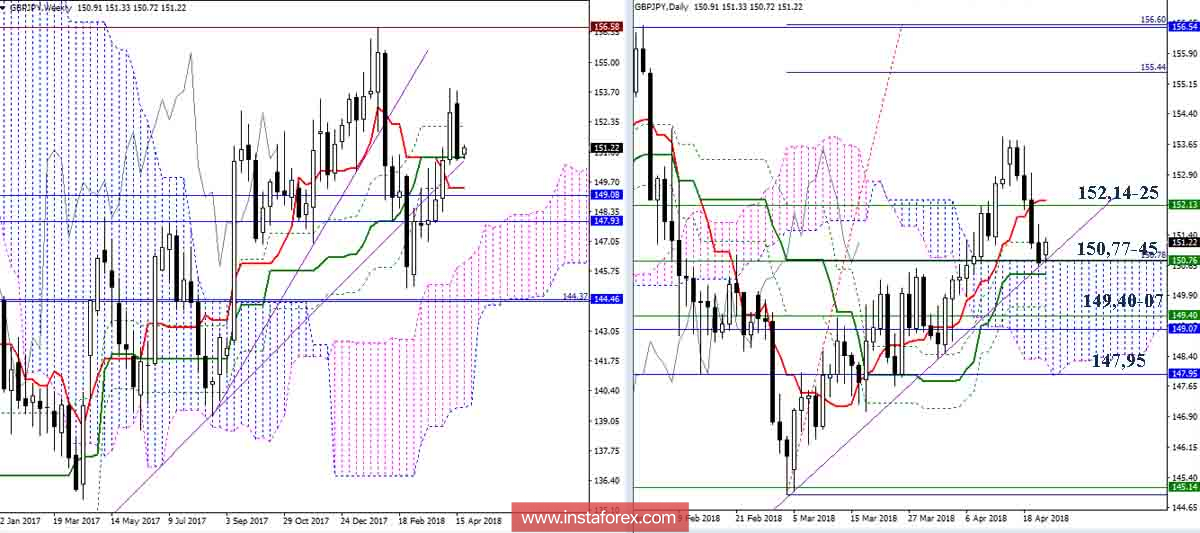

Senior timeframes

The pair went down to designated supports 150.77 - 150.45 (weekly Kijun + day Kijun + daytime Senkou Span B) and closed last week with good prerequisites for continuing the decline. At the moment, the strength of the supported supports can form a braking, perhaps the players on the upgrade will try to restore positions. In this case, the resistance should be noted in the area of 152.14-25 (day Tenkan + weekly Fibo Kijun). Overcoming the support zone 150.77-45 opens prospects for a reduction in areas of the congestion of the supports 149.40-07 and 147.95.

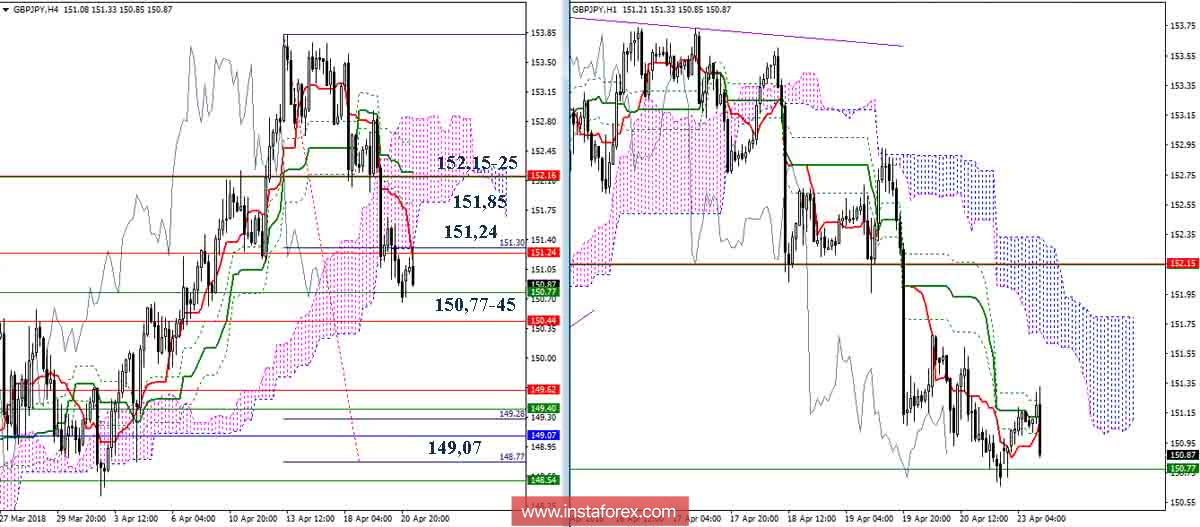

H4-H1

The junior timeframes are ready to fully support the players on the slide and provide them with a downside target for the breakdown of the H4 cloud, so the passage of the supported upper half times (150.77-45) will allow the reduction of the benchmarks which are now concentrated in a fairly wide support zone. The support zone center can be identified around 149.07 (the monthly Fibo Kijun). For players on the downside, everything now rests on 150.77-45, so rivals can take advantage of the situation. With the rise, 151.24 (Tenkan H4 + cross H1 + high-time level) will have a value today, then 151.85 (Senkou Span B N4 + H1 cloud) and 152.14-25 (Kijun H4 + high-time levels).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română