The US dollar continued to rally in the wave of growth in government bond yields as well as the reduction in geopolitical risks. Also, as previously mentioned, it is supported by the remarkable decline in expectations for interest rates to be raised by other Central Banks whose currencies are traded on the Big Forex.

On Monday, the benchmark yield of 10-year Treasury came close to 3.0%, reaching 2.998% at the moment, but then rolled back. This morning, the yield is at 2.964%.

It is believed that when the yield exceeds 3.0% and rushes to 3.25%, then it will deal a serious blow to the US stock market which would likely increase risks due to a surge in the cost of borrowing for security purchases with leverage. By the way, the local share market was characterized by low activity on this wave yesterday, despite the continued publication of corporate reports by companies. The focus of the market was on the dynamics of US debt securities.

The market analyzes the situation in the US economy, as well as the behavior of government debt securities, and tries to understand the prospects for the US dollar. We have already stated our view on the possible scenarios for the development of events which were based on several important factors such as geopolitical risks, prospects for tax reform in the United States, rising inflation pressures and, as a consequence, the continuation of the Fed's interest rate increase cycle. It is believed that all these factors are actively moving in a complex manner. These are called internal American factors but there is one more of the main external ones which were the focus of attention, that is the beginning of the tightening of monetary policies by major Central Banks including the Bank of England or the ECB, and also the CBA of Canada, Switzerland, etc. But recently, the influence of this factor has noticeably fallen on the wave of already internal causes in the economies of these countries.

With this, it can be assumed that the dollar may continue to be supported and gradually gain strength over main currencies. Also, this growth will only increase if yields on Treasury bonds of the US Treasury continue to rally.

Forecast of the day:

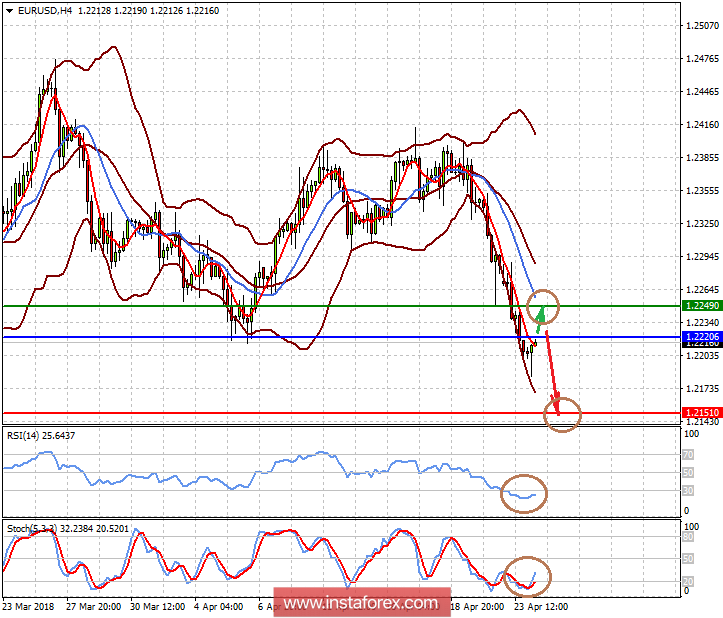

The EUR/USD currency pair remains under strong pressure, but on the eve of the meeting, the ECB could grow to 1.2250 if it overcomes the 1.2220 mark. But we continue to expect a weakening of the price after the meeting of the regulator. Against this background, the pair may continue to decline to 1.2150.

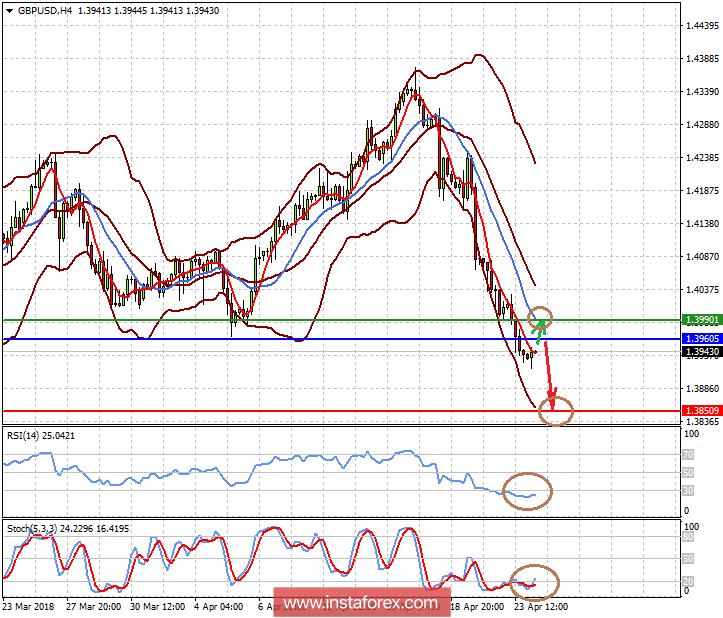

The GBP/USD pair may also try to rise to 1.3990 on the wave of technical oversold after overcoming the level of 1.3960. We believe that it should be sold on growth with a probable target of 1.3850.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română