GBP / JPY pair

Higher timeframes

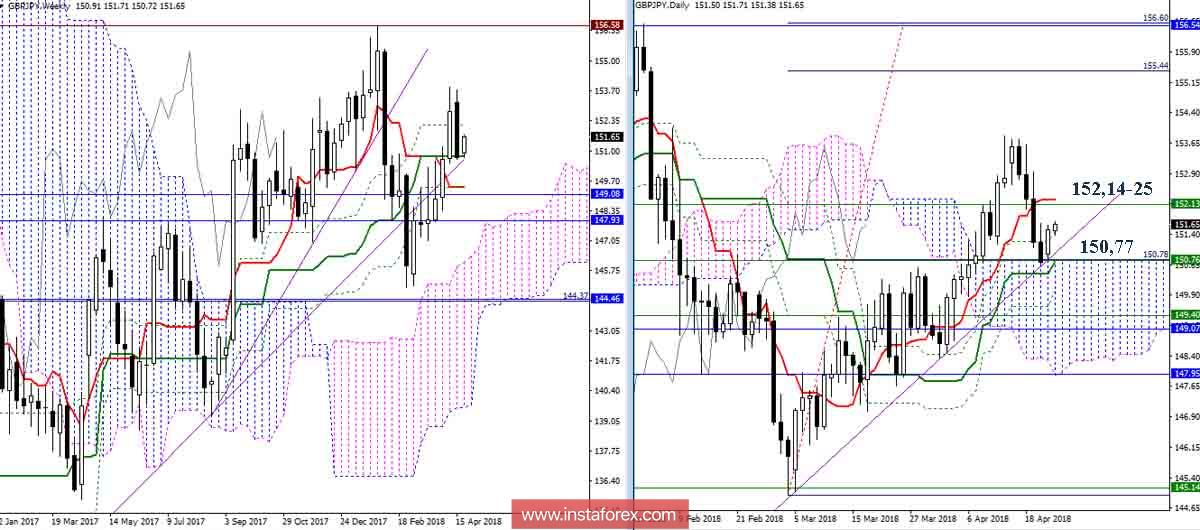

The strength of the support levels helped to slow down and even form a slight rebound on the afternoon. However, the daily short-term trend is still on the side of the players on the fall, joining forces with the weekly Fibo Kijun in the area of 152.14-25. Reliable consolidation above these resistance levels can make adjustments to the existing balance of forces. For players on the fall, The main task for today is still the support breakdown at 150.77 (weekly Kijun + daytime Kijun + daytime Senkou Span B). Overcoming this support will open up prospects for the bears.

H4 - H1

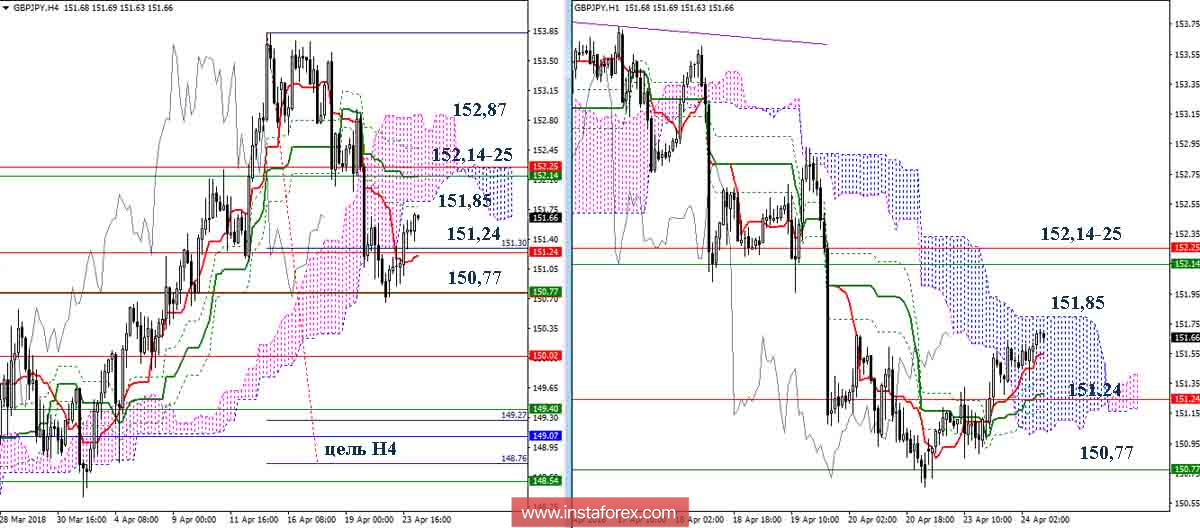

The week began with the development of an upward correction and the most significant reference points are the clouds of lower dimes (151.85 - 152.87) and the change of the H4 cross (Kijun 152.13). These benchmarks are strengthened by the resistance of the upper half (152.14-25). If the corrective lift is now complete as supported by the resistance level, the bears return to 151.24 and 150.77, the downside target will again be the downside target for H4 (148.76 - 149.27) and the accumulation of the levels of the older time intervals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română