To open long positions on EURUSD, it is required:

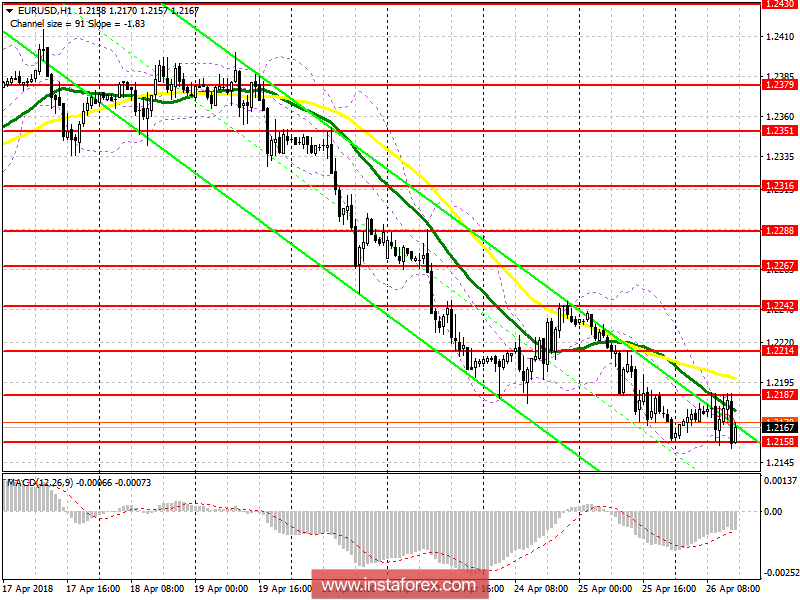

There are no changes in the market. The whole movement will depend on the statements of Mario Draghi. Buying the euro is best after consolidating above the resistance level of 1.2187. This will lead to the correction towards the area of 1.2214, where the upper limit of the descending channel passes. Going beyond this range will also allow us to count on a more powerful bullish pulse in the area of 1.2242 and 1.2267, where it is recommended to lock in profits. In case the euro falls below the level of 1.2158 after Draghi's speech, buying is best returned to after the update of the supports areas of 1.2127 and 1.2088.

To open short positions on EURUSD, it is required:

The consolidation below the level of 1.2158 against the backdrop of the ECB President's speech will be a good signal to increase short positions in the euro with the aim of reducing to the region of new lows at the area of 1.2127 and 1.2088, where it is recommended to lock in profits. Given the growth of the euro above the level of 1.2187, selling the euro is best after the renewal of the resistance areas at 1.2214 and 1.2242.

Indicator description

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română