On Friday, the growth of the US dollar stopped on the wave of profit-taking before the weekend, as well as a decline in the yield of government bonds of the US Treasury. However, such a decline is hardly worth considering as an end to the dollar rally, which is likely to resume this week.

Decrease in the yield of government bonds should be regarded as a temporary factor. It seems that the growth in yield will continue on the wave of expectations of the implementation of the process of raising the interest rates of the US Federal Reserve on the background of positive news from the labor market and the prospects for rising inflationary pressures. After lowering the profitability of the benchmark of 10-year Treasury on Thursday and Friday, it resumed the upward trend this the morning by 0.37%, to 2.968%.

This week, there will be important published data on inflation indicators which are the values of costs and incomes of Americans. In addition, there will be figures of the basic index on personal consumption (RFE), which recently has a central place in the decision by the US interest rate regulator. It is expected that revenues will grow as well as spending for March, by 0.4%, with expenses to be added more than it was in February, when the indicator added only 0.2%. At the same time, the annual value of the RFE index should approach the target level of 2.0, rising 1.9% against the February 1.6%. If the data does not disappoint, then it will support the dollar against the other major currencies.

Another plus for the dollar will be the outcome of the Fed's meeting on monetary policy. We do not expect that the rates will be raised, but the declaration of the continuation of the process of further raising the cost of borrowing will support the dollar as well as good employment data that will be released this Friday. It is assumed that the number of new jobs will grow in March by 185,000 while the unemployment rate will decrease from 4.1% to 4.0%.

In general, we believe that the dollar has the opportunity to continue the upward trend this week.

Forecast of the day:

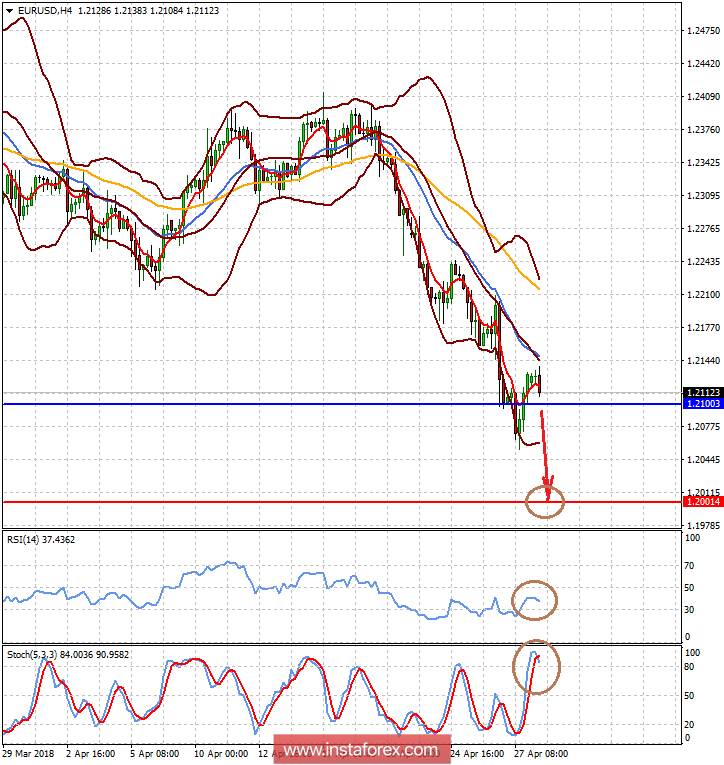

The EURUSD pair remains under pressure in anticipation of the publication of important inflationary indicators from the US, which could push the pair to a further drop to the level of 1.2000 after overcoming the level of 1.2100.

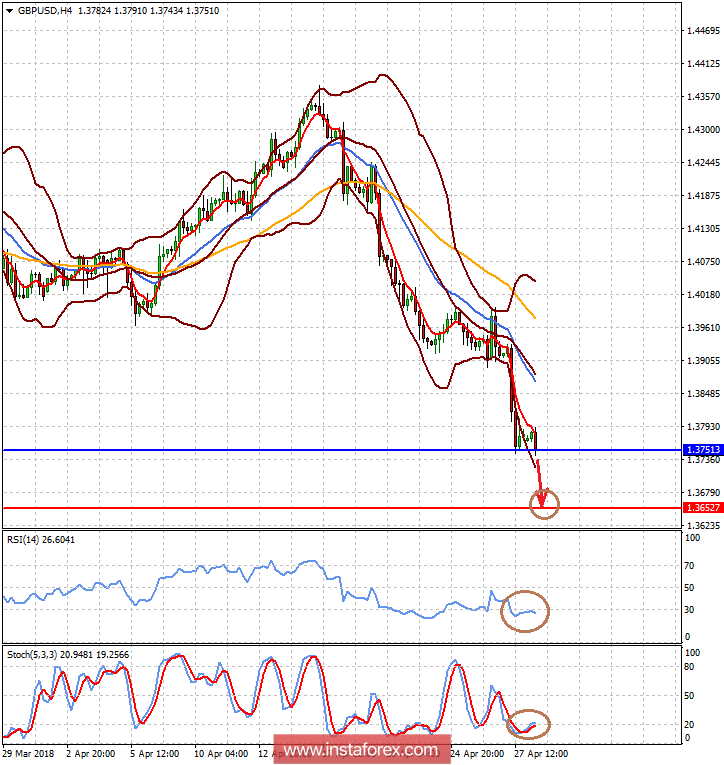

The GBPUSD pair is trading at 1.3750. Overcoming this mark may lead to a fall in the pair to 1.3650.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română