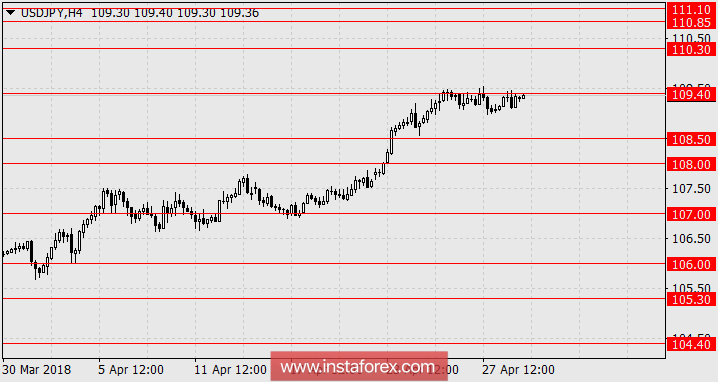

USD/JPY Over the past three days, the yen has returned to a high of April 25th with the help of the overall growth of the US dollar. The stability of the Japanese currency against yesterday's decline in the stock market (Dow Jones -0.61%) indicates a strong market confidence in the intentions of the Japanese Central Bank to continue the ultra-soft policy at the current inflation of 1.1% to 2.0% target. Today, the final estimate of Manufacturing PMI for April was raised to 53.8 from 53.3. Asian stock indexes are growing: Nikkei 225 0.14%, Shanghai Composite 0.23%, S&P/ASX 200 0.53%, IDX Composite 1.27%. Tomorrow, Japan will release the index of consumer confidence for April, a forecast of 44.6 versus 44.3 in March. Against the backdrop of expectations of the growth of the US dollar in connection with the expected good statistics and a new impulse to strengthen at the FOMC meeting of the Fed, which will be tomorrow, we expect the yen to rise to 110.30 and further towards the range of 110.85-111.10. |

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română