To open long positions on EURUSD, it is required:

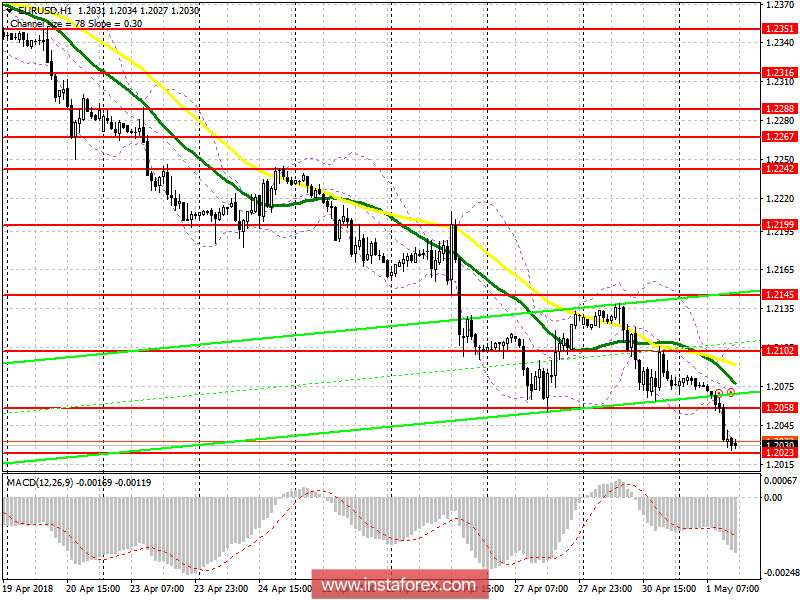

The calculation of euro buyers is now reduced to the level of support 1.2023, but to open long positions from it is best when forming a false breakdown. Under the scenario of a breakdown, one can immediately buy euros for a rebound from 1.1987. The main target of the buyers will be the return and consolidation by the end of the day at the level of 1.2058.

To open short positions on EURUSD, it is required:

Repeated test 1.2023 could lead to a new wave of selling the European currency in order to update the next low in the support area 1.1987. In case of EUR/USD growth in the second half of the day, one can count on selling after an unsuccessful fastening above 1.2058, or on a rebound from 1.2102.

Descriptors

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română