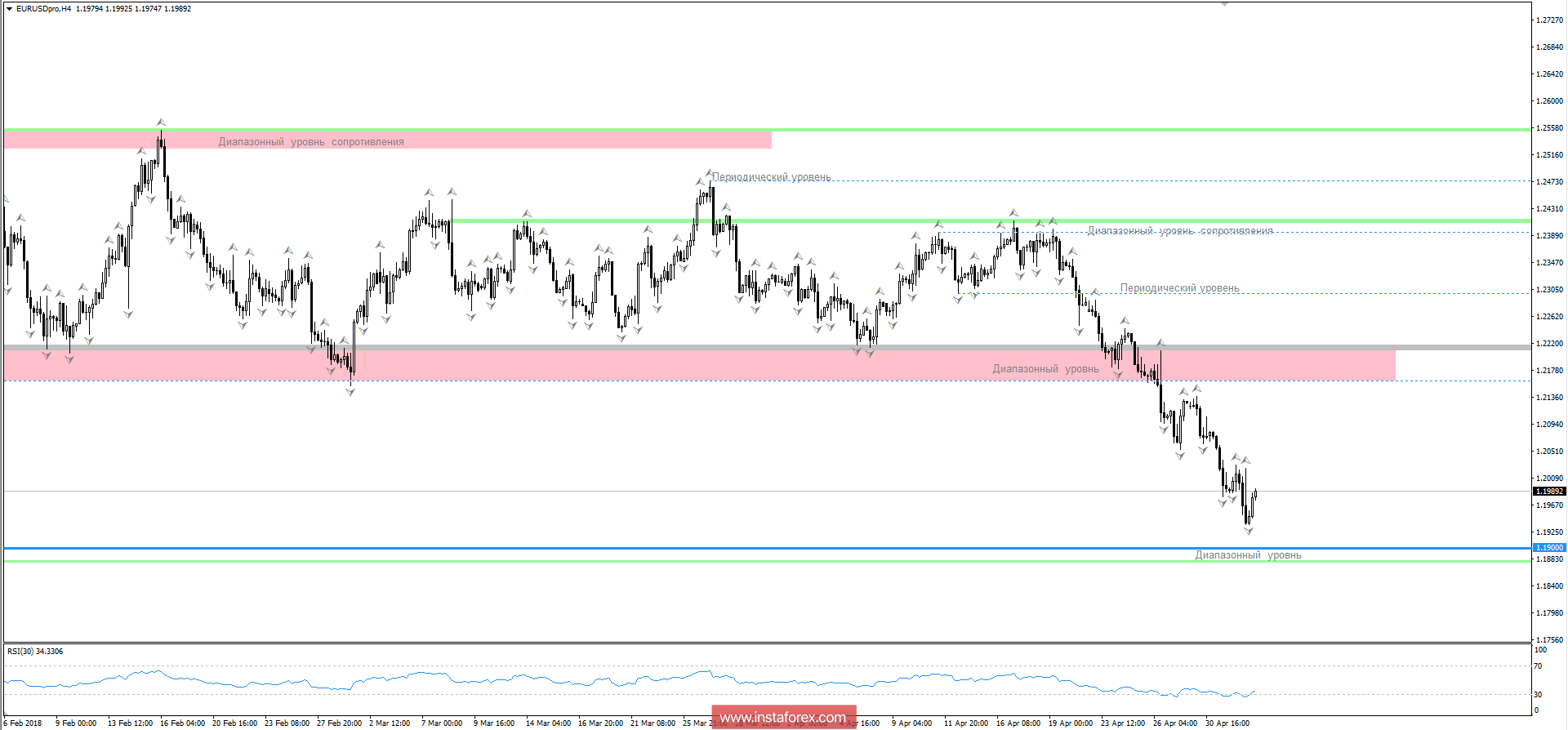

The single European currency has so far failed to reverse the ongoing strengthening of the dollar. However, so far this has not worked out due to the lack of positive news that could launch a correction that has ripened long ago. Today, such an occasion may be data on inflation in Europe. Although inflation itself should remain unchanged, producer price growth rates could accelerate from 1.6% to 2.1%. This means that the probability of inflation growth in the near future is extremely high. An additional factor may be the data on the number of applications for unemployment benefits in the US, which should increase by 17 thousand. Only data on production orders, which are expected to increase by 1.4%, may somewhat reduce the scale of the maturing correction.

The euro / dollar currency pair continued its downward movement close to the range support level 1.1900, felt the support and moved to the stage of a pullback. It is possible to assume that the quotation will not stop on the rollback, there is oversold, and the current level of 1.1900 can perfectly approach for the formation of correction 1.2100 / 1.2200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română