The correction of the pound and the euro is postponed from time to time due to insufficient reasons for starting it. Today, the reason for inflation should be in Europe, and the single European currency through the index of the dollar will recover among other currencies if the forecasts are confirmed. Initially, the British pound may find a reason for the growth from the business activity index in the services sector, which is expected to grow from 51.7 to 53.5. An additional reason may be data on the number of US applications for unemployment benefits, which may increase by 17 thousand. However, it seems that the correction will not be deep and extended due to production order data, which is expected to grow by 1.4%.

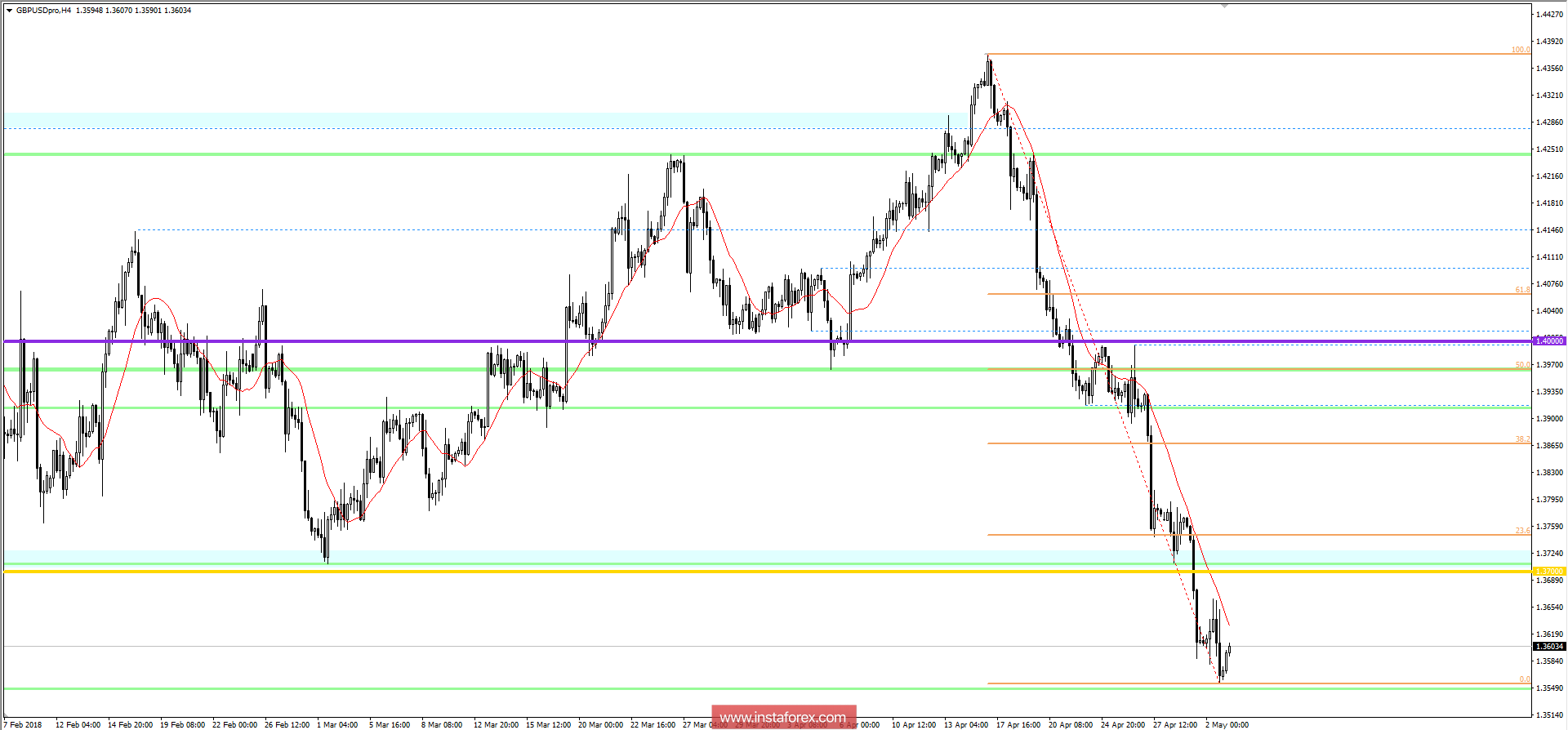

The pound/dollar currency pair draws us a practically vertical movement, where we got 800 points of the move within two and a half a week. As of the moment, the quotation has already reached the periodic level of 1.3550, leaving behind the impulse candles and the increasing oversold. It can be assumed that buyers will hold all possible levels to form a correction, where the first value in the case of a rebound will be 1.3720 with further consideration of 1.3860.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română