Speech by ECB representative Villeroy in the morning did not support the European currency, which continued to lose ground in a pair with the US dollar.

According to Villeroy , confidence in the movement of inflation in the right direction has intensified, but much remains to be done to ensure price stability. The ECB representative also noted that the fiscal problems will not affect the monetary policy of the Central Bank.

Toward the second half of the day, all attention was focused on the Bank of England's decision on the interest rate. Most economists agreed that the Bank of England would leave a key interest rate at 0.5%, which happened. After this decision, the British pound seriously strengthened its positions, and for this, there were a number of reasons.

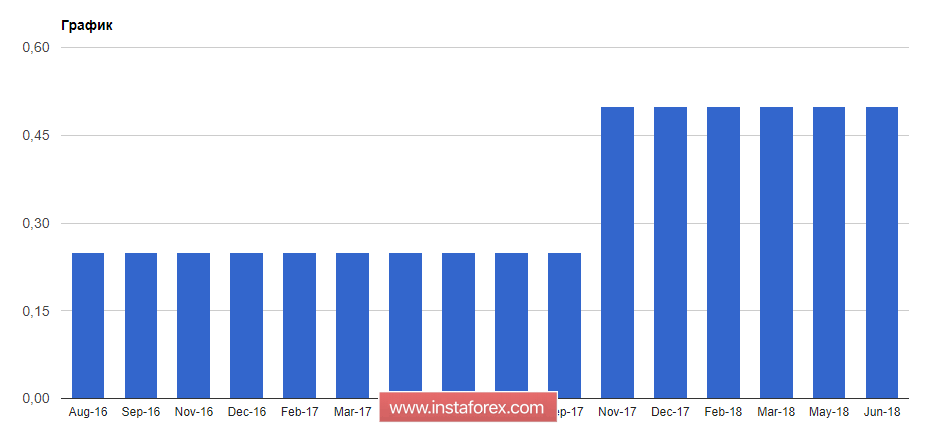

First of all, the decision to keep the key rate at the level of 0.5% was taken with the voting ratio of 6 to 3. The number of votes for raising the key rate was 3. Also, the Bank of England signaled that the portfolio of assets would soon be reduced. The regulator expects that it will begin to reduce the number of bonds in its holding after when the key interest rate will rise to 1.5%, although previously it was about 2%.

Given the planned increase in the interest rate this year, subject to stable economic growth, the program may begin to cut in early 2019.

As the leaders of the Bank of England noted, the slowdown in the economy in the first quarter of this year was temporary, but most of them lowered the outlook for the world economy.

In the first half of the day, data on public sector borrowing from the UK came out, which in general were ignored by the market.

According to a report by the National Bureau of Statistics, the net borrowing of the public sector in May 2018 amounted to 5 billion pounds against 7 billion a year earlier. As noted in the ONS, since the beginning of this year, the level of borrowing was 39.5 billion pounds.

The Swiss National Bank today left the key rate at the level of -0.75%. As noted in the report, despite signs of accelerating the growth of the country's economy and the slow growth of inflation, the rate will remain unchanged for quite a long time.

Considering the demand for safe-haven assets, the Swiss National Bank is concerned about the steady growth of the national currency rate, in connection with which the regulator signaled its readiness to intervene in the foreign exchange market, as necessary.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română