To open long positions for EUR / USD pair, you need:

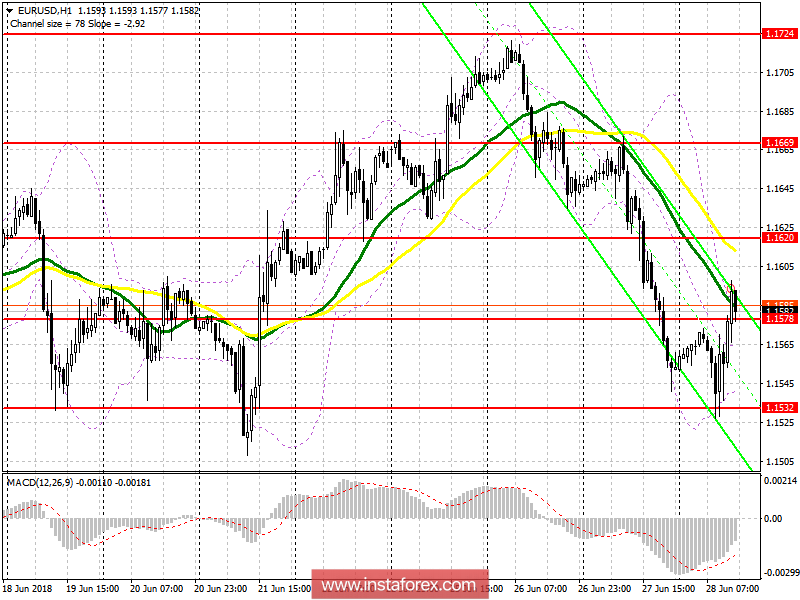

Buyers have coped well with the levels mentioned in my morning forecast. And now, it is trying to cling to the resistance of 1.1578, which in the second half of the day can fulfill the role of support that will strengthen the upward impulse. This allows updating the resistance level of 1.1620, where fixing profits are recommended. In the event of the EUR / USD pair returning under the support level 1.1578 in the afternoon, returning to the purchases is best for a rebound from 1.1532.

To open short positions for EUR / USD pair, you need:

The bears have no choice but to try returning to the level of 1.1578, below of which there will be fixation of profit on long positions. This will lead to a decrease of the EUR / USD pair to the area of the day's lows to support level of 1.1532. In the case of further growth, you can sell the euro after a false breakout at 1.1620, or on a rebound from 1.1669.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română