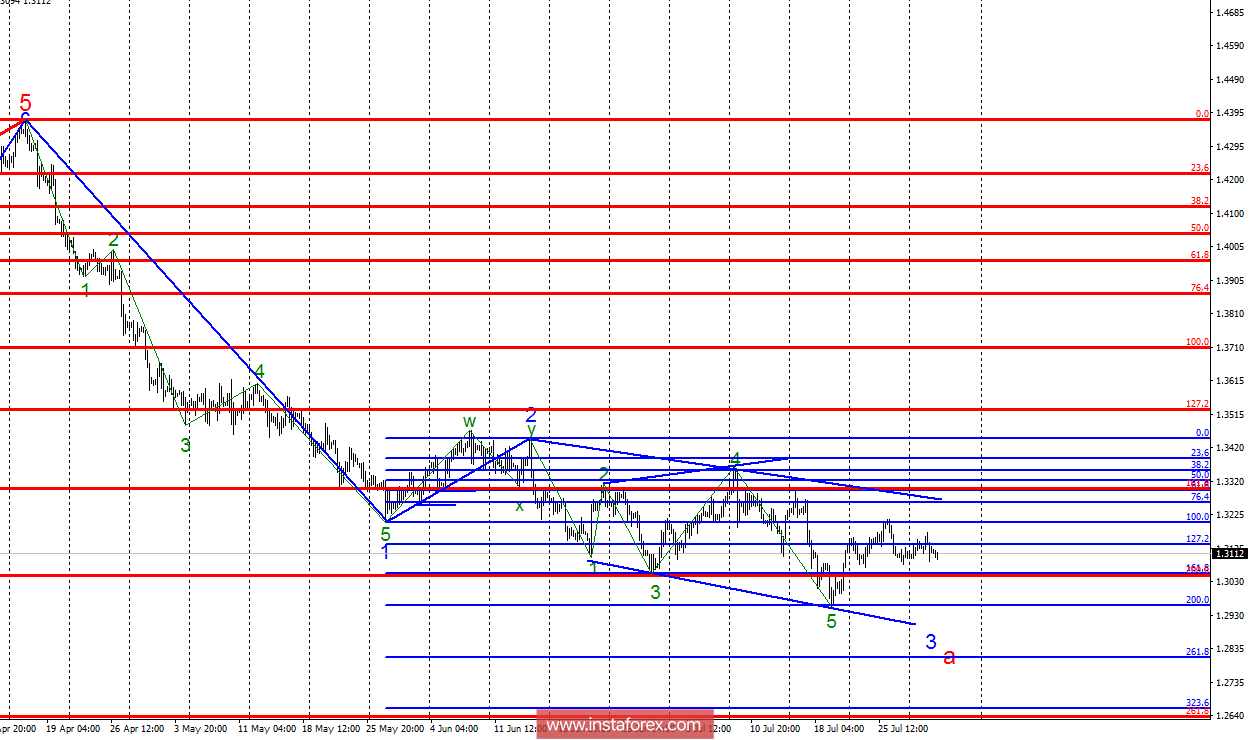

Analysis of wave counting:

During the trades on July 31, the GBP / USD currency pair did not change its exchange rate value. Today, there will be a meeting of the Fed, which may well create a new pressure on the pound, which continues to trade within the downward corridor, maintaining the likelihood of complicating the downward portion of the trend, which begins on June 14. The entire wave 3, a, in this case, will take a more complicated form. Determine the completion of the construction of the downward section of the trend will be possible by a successful attempt to break the upper generatrix downward corridor line. In this case, the pair can proceed to build an upward trend section.

The objectives for the option with purchases:

1.3301 - 16108% of Fibonacci (the oldest Fibonacci grid)

The objectives for the option with sales:

102962 - 200.0% of Fibonacci

1.2809 - 261.8% of Fibonacci

General conclusions and trading recommendations:

The currency pair GBP / USD is still in the framework of constructing a downward trend section, despite the fact that wave 3, a, and can be completed. However, meetings of the Bank of England and the Federal Reserve can change the current wave counting. Anyway, in the next two days, the wave pattern should clear up. Now, I recommend that in small volumes, sell the pair with targets located near the estimated mark of 1.2962, which corresponds to 200.0% of Fibonacci. The prerequisites for buying a pair now are not.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română