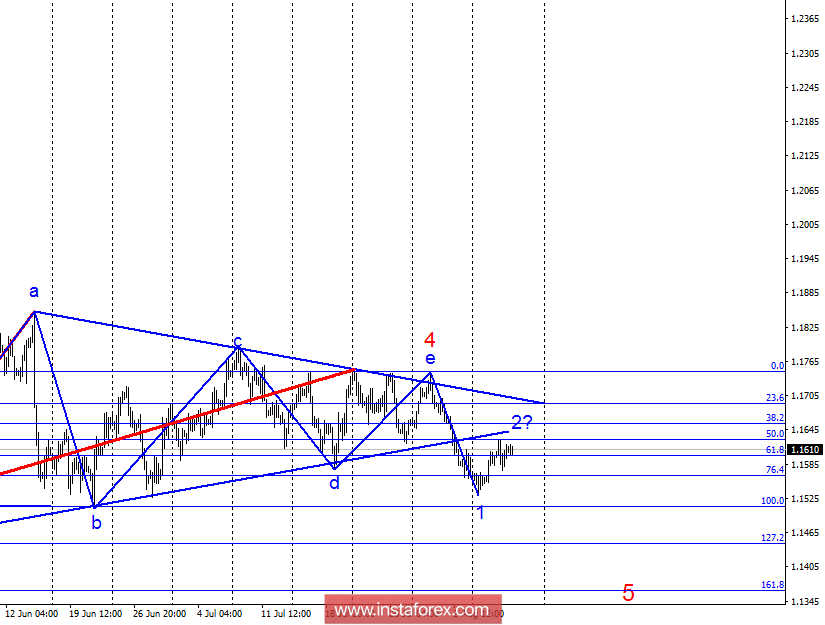

Analysis of wave counting:

During the trading on Wednesday, the EUR / USD currency pair gained about 10 percentage points and is preparing to complete the construction of the proposed wave 2, 5, downward part of the trend. If this assumption is correct, then the decline in quotations will resume today or a maximum tomorrow in the framework of the construction of wave 3, 5, with targets below 15 figures. A successful attempt to break the downward trend line will lead to the idea of the tool's willingness to build an ascending set of waves, and the current wave counting will require adjustments. However, there is no reason to assume the execution of such an option now.

The objectives for the option with sales:

1.1507 - 100.0% of Fibonacci

1.1444 - 127.2% of Fibonacci

The objectives for the option with purchases:

1.1834 - 200.0% of Fibonacci

1.1957 - 161.8% of Fibonacci

General conclusions and trading recommendations:

The wave 5 of the descending section of the trend continues its construction. Thus, on August 9, I recommend continuing the formation of sales of the pair with targets located near the estimated levels of 1.1507 and 1.1444, which equates to 100.0% and 127.2% of Fibonacci, pending the construction of wave 3, 5. I recommend buying back to purchases not earlier than the breakthrough of the trend line and after specifying the wave counting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română