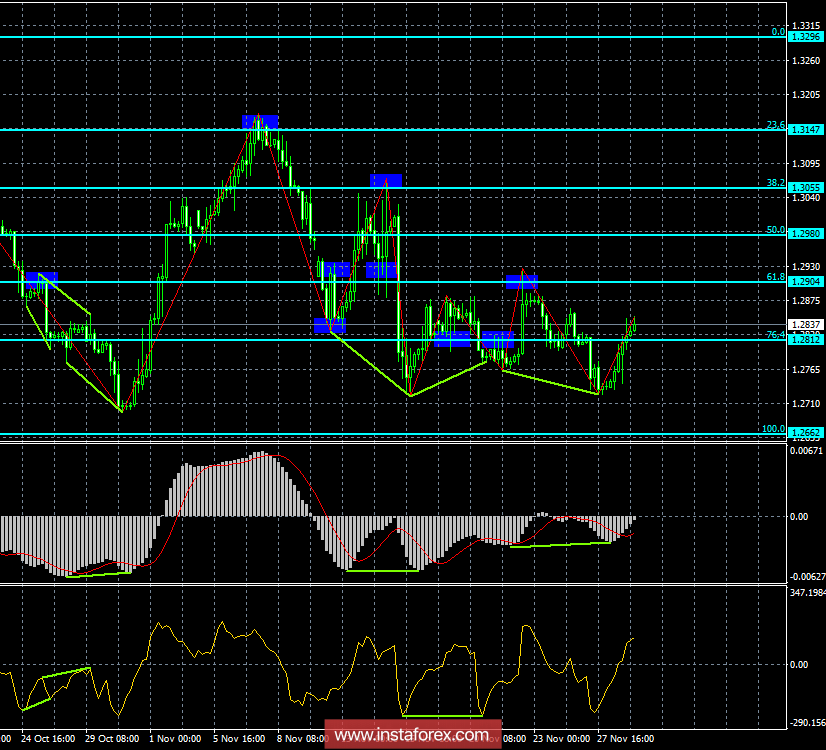

4h

The GBP / USD currency pair on a 4-hour chart after the formation of a bullish divergence performed a reversal in favor of the British currency and consolidation above the correction level of 76.4% - 1.2812. As a result, the growth of quotations can be continued in the direction of the next Fibo level of 61.8% - 1.2904. There are no ripening divergences on November 29th. Fixing quotations below the Fibo level of 76.4% can be interpreted as a reversal in favor of the US currency and the resumption of a fall in the direction of the correction level of 100.0% - 1.2662 can be expected.

The Fibo grid was built on extremes from August 15, 2018, and September 20, 2018.

1h

On the hourly chart, the pair closed above the correction level of 76.4% - 1.2809. Thus, the growth of quotations can be continued in the direction of the next correctional level of 61.8% - 1.2878. On November 29, the bearish divergence is brewing at the CCI indicator. The education will allow traders to expect a reversal in favor of the American currency and a return to the Fibo level of 76.4%. Fixing the pair below the correction level of 76.4% will increase the probability of a further fall in the direction of the next Fibo level of 100.0% - 1.2696.

The Fib net is built on extremes from October 30, 2018, and November 7, 2018.

Recommendations to traders:

Purchases of the GBP / USD currency pair can be carried out now with a target of 1.2878 and a Stop Loss order under the correction level of 76.4%, as the pair completed closing above the level of 1.2809 (hourly chart), and hold them until a bearish divergence is formed.

Selling of the GBP / USD currency pair will be possible with the target of 1.2809 and a Stop Loss order above the level of 61.8% if the pair bounces off the level of 1.2878 (hourly chart) or a bearish divergence is formed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română