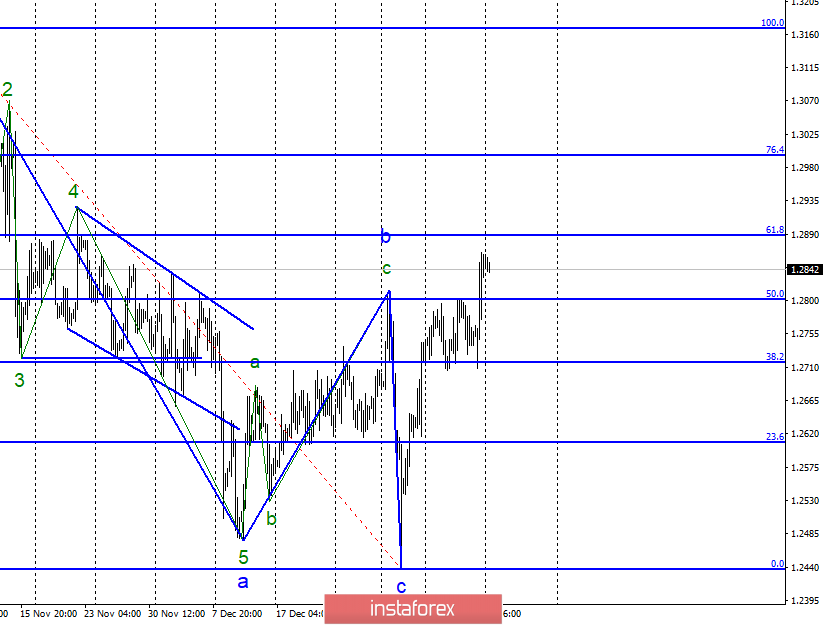

Wave counting analysis:

On January 11, the GBP / USD pair added about 90 bp. It broke through the maximum of the previous upward wave and the wave pattern.As a result, it requires making adjustments. Thus, the wave with turned out very shortened, nevertheless, it went beyond the minimum of wave a. The tool has moved to the construction of a supposedly upward trend section with targets that are near the 61.8% and 76.4% levels s on the Fibonacci grid, built on the size of the last three wave descending wave structure.

1.2887 - 61.8% Fibonacci

1.2997 - 76.4% Fibonacci

Sales targets:

1.2716 - 38.2% Fibonacci

1.2609 - 23.6% Fibonacci

General conclusions and trading recommendations:

The pair GBP / USD has moved to build a new uptrend trend, and the current wave pattern has undergone certain changes. Based on the new markup, an increase in the tool is expected, and I recommend cautious purchases with targets at 1.2887 and 1.2997. However, tomorrow in the parliament of Great Britain, a vote on the conditions of Brexit which was proposed by Teresa May, should take place. Any information from the parliament can greatly affect the movement of the instrument.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română