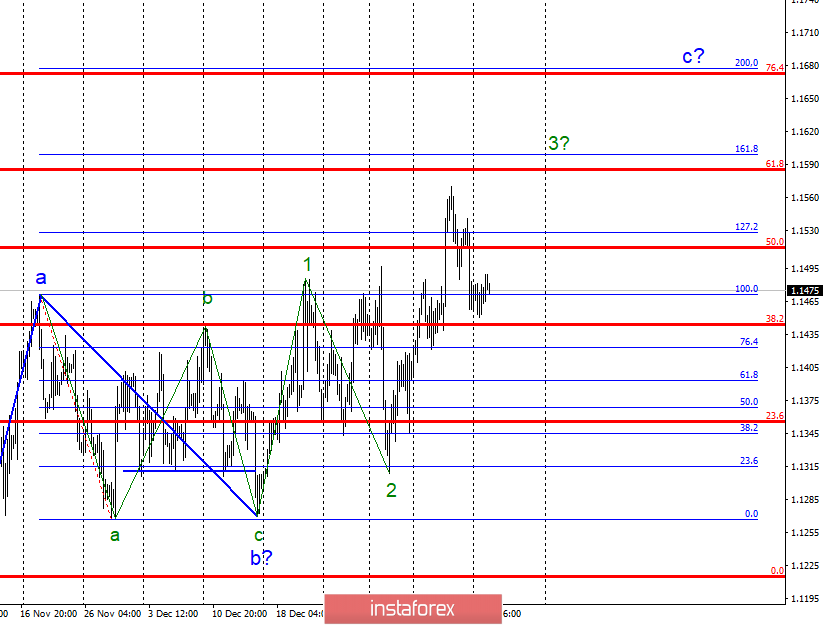

Wave counting analysis:

On Monday, January 14, trading ended for EUR / USD with a minimum increase of 10 bpts. Thus, it can be said that the wave marking has not changed at all. And from the current position, it is expected to resume the instrument increase within the estimated wave 3 and c with targets located near the Fibonacci level of 161.8%. Today, in the UK, there will be a vote on the plan of Theresa May on the country's withdrawal from the EU. This event can affect not only the pound, but also the euro. So today, you need to be ready for any development of events.

Sales targets:

1.1444 - 38.2% Fibonacci (formal goal)

Shopping goals:

1.1599 - 161.8% Fibonacci

1.1677 - 200.0% Fibonacci

General conclusions and trading recommendations:

The pair continues to be in the construction stage of the proposed wave 3 in s. Now, I still recommend buying the instrument with targets located near the estimated marks of 1.1599 and 1.1677, which corresponds to 161.8% and 200.0% in Fibonacci. Correctional wave of 3, s can already be completed. But during this day, sharp changes of direction are possible, as it is possible to receive important information from the UK on Brexit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română