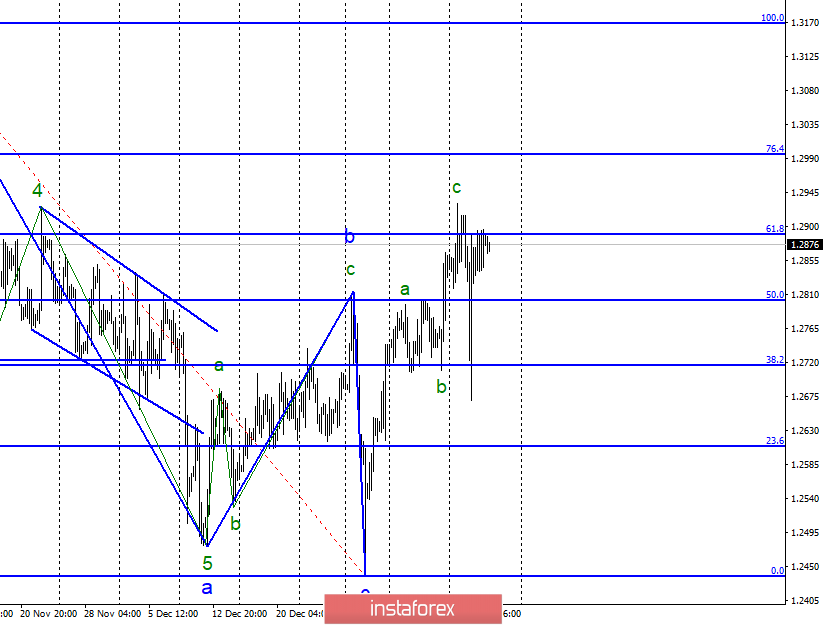

On January 16, the GBP / USD pair gained about 20 bp. The amplitude of the instrument has decreased to a minimum, which is rather strange, given the scale of recent events in the UK. Yesterday, the parliament did not approve Theresa May's resignation, but so far no reaction has been received to this event. More so, the wave pattern of the trend section, taking its beginning on January 2, looks quite ambiguous. Most likely, the pair continues to build three-wave structures, and if this is true, then it's possible from current positions.

Shopping goals:

1.2997 - 76.4% Fibonacci

Sales targets:

1.2716 - 38.2% Fibonacci

1.2609 - 23.6% Fibonacci

General conclusions and trading recommendations:

The GBP / USD pair made an unsuccessful attempt to break through the Fibonacci level of 61.8%, which suggests that the instrument is ready to build a downward wave or a set of waves. The wave pattern is now confused, and, given the importance of current events in the UK, there is reason to expect new instrument jerks in different directions, which are difficult to predict now. Thus, I recommend monitoring the situation in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română