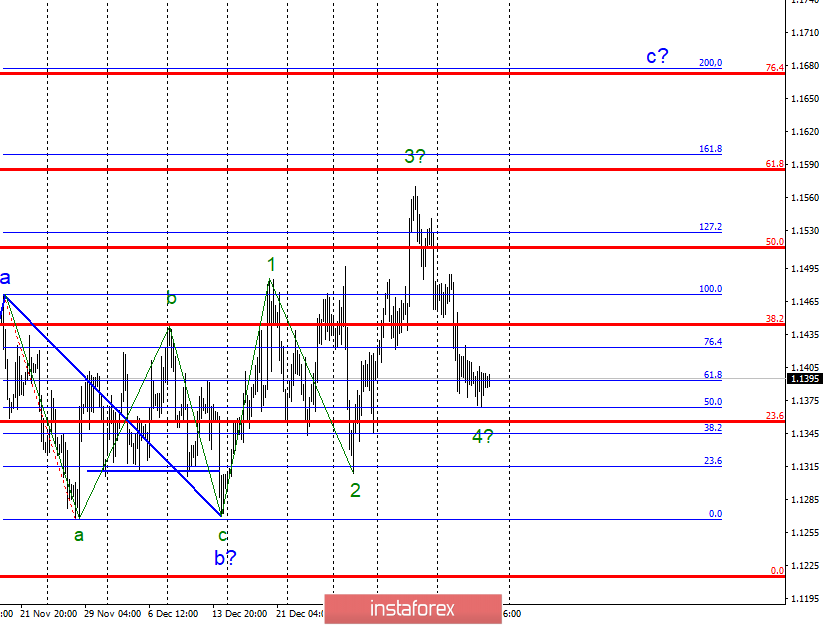

On Thursday, January 17, trading ended for EUR / USD by a decrease of as little as 5 bp. Thus, the uptrend trend, taking its beginning on November 12, takes an ambiguous and complex look, but retains the prospects for its development. The whole wave takes the form of a diagonal triangle. Reducing the pair continuously can lead to a strong complication of the current wave pattern. Nevertheless, an unsuccessful attempt to break through to the nearest Fibonacci levels could lead to a resumption of a rise within wave 5.

Sales targets:

1.1345 - 38.2% Fibonacci

1.1315 - 23.6% Fibonacci

Shopping goals:

1.1599 - 161.8% Fibonacci

1.1677 - 200.0% Fibonacci

General conclusions and trading recommendations:

The pair continues to build the estimated wave 4, in s. Since the wave with does not look fully equipped, I expect the resumption of raising the tool and recommend purchases with targets located near the estimated marks 1.1599 and 1.1677. More so, I recommend placing protective orders below the 23.6% Fibonacci level, which is the minimum of the expected wave of 2, in s.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română