To open long positions on GBP/USD, you need:

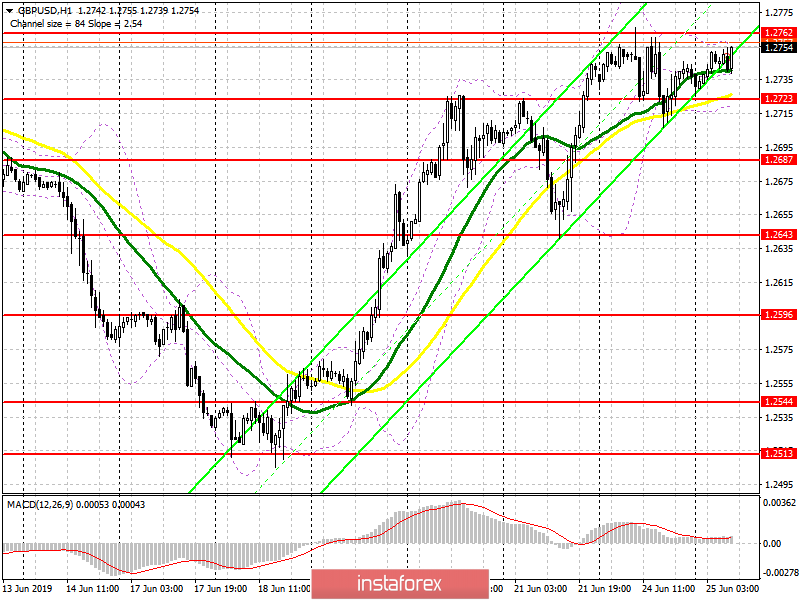

The technical picture for the pound has not changed. The purpose of the bulls is a major resistance of 1.2762, the breakthrough of which will provide good support to buyers, which will lead to the update of the highs in the area of 1.2800 and 1.2860, where I recommend taking the profit. In the downward correction scenario, you can look at long positions in the pound on a false breakout from the support of 1.2725 or on a rebound from the minimum of 1.2687.

To open short positions on GBP/USD, you need:

Like yesterday, the sellers of the pound will try not to let the pair above the resistance of 1.2762, and the formation of a false breakout there will be a direct signal to open short positions against the trend, counting on a larger downward correction to the support area of 1.2725 and 1.2687, where I recommend taking the profit. However, more interesting levels for selling GBP/USD today are seen at the highs of 1.2799 and 1.2858.

Indicator signals:

Moving Averages

Trading is conducted above 30 and 50 moving averages, which indicates the bullish nature of the market.

Bollinger Bands

If the pound falls, the support will be provided by the lower limit of the indicator in the area of 1.2725.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română