4-hour timeframe

Technical data:

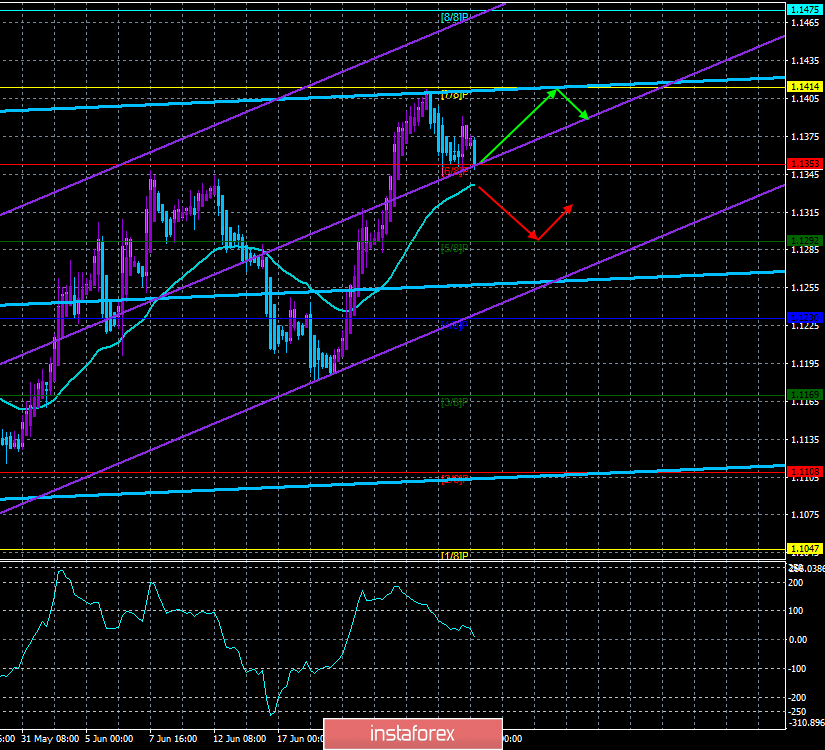

The upper linear regression channel: direction – up.

The lower linear regression channel: direction – up.

The moving average (20; smoothed) – up.

CCI: -10.0842

The confrontation between US President Donald Trump and Fed Chairman Jerome Powell continues. Yesterday, another ouster of criticism for the "wrong" monetary policy spilled over the head of the second. Earlier, Donald Trump criticized the Fed for too frequent rate hikes, now – for the lack of reduction. Jerome Powell, like other members of the Fed, seems to have already made it clear to the markets that a reduction in the key rate is possible in 2019. But Trump, as usual, needs everything here and now. He reiterated that he can dismiss Powell from his position, which brought the legal community and traders into deep thought. Formally, Trump has such an opportunity, but in the history of America, such has never happened that the President dismissed the head of the Fed. It is unlikely that this will be done without a very good reason because Congress will have to approve the removal of Powell. While these reasons are not possible, Trump continues to only threaten the Fed. Meanwhile, the euro/dollar pair came close to the moving average line. The location of the price above it keeps the upward trend in the market, but overcoming it again will return to the game of bears. Today, the US will once again have an important macroeconomic report – annual GDP data for the first quarter. Traders expect a 3.1% growth. Given the failed statistics in recent weeks, we can assume that the real value will be lower than the forecast. But will it cause sales of the dollar?

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading recommendations:

The EUR/USD currency pair continues its downward correction to the moving average. Thus, it is now recommended to wait for the reversal of the Heiken Ashi up or rebound from the moving and buy the pair again with the target level of 1.1414.

It is recommended to buy the US currency after traders consolidate below the moving average line, which will change the trend to a downward one, with the first targets of 1.1292 and 1.1230.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română