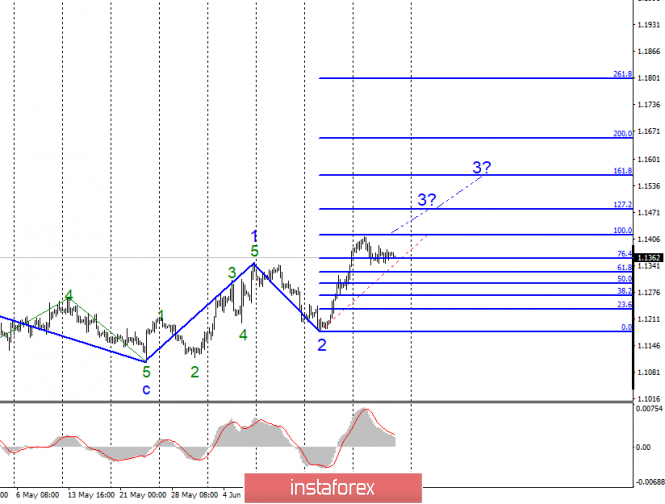

EUR / USD

Thursday, June 27, ended for the pair EUR / USD with no changes. The activity of the foreign exchange market has greatly decreased, perhaps because of a very important event that starts today and ends tomorrow. We are talking about the G-20 summit, which would unlikely have attracted such an amount of attention if it were not for the planned meeting of Presidents Trump and Xi Jinping to hold a new round of negotiations on trade disagreement. Thus, markets are not set up either positively or negatively, since they are just waiting for what decision will be made and whether there will be progress in the negotiations. US Treasury Secretary Steven Mnuchin said that 90% of the parties have already agreed, but this does not mean that the leaders of China and the United States can only sign and withdraw duties from each other. Moreover, it is possible that Mnuchin just tried to calm the markets, knowing full well that Donald Trump by his actions and so strongly excites them. There is no need to panic. After the summit is over, I think it will become clear whether the upward trend segment will continue to be built, or whether the segment will be transformed into a 3-wave structure after May 23.

Purchase goals:

1.1417 - 100.0% Fibonacci

1.1480 - 127.2% Fibonacci

Sales targets:

1.1180 - 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair is presumably located within the 3 waves of the upward trend. I recommend buying euro currency with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, with the MACD signal up. Now, the correctional wave continues its construction.

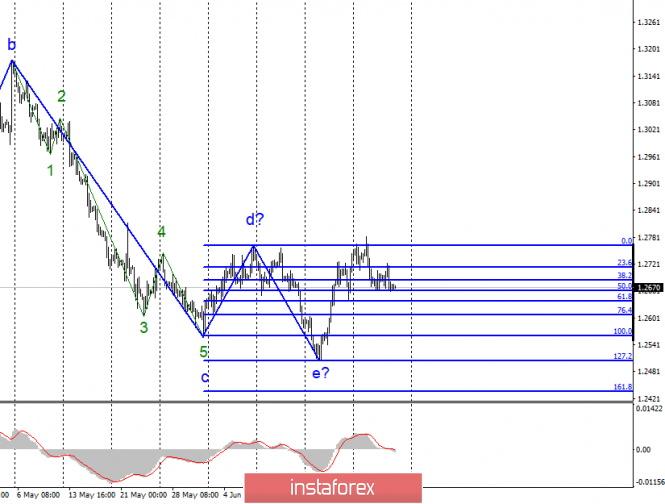

GBP / USD

Everything written about the EUR / USD pair also applies to the GBP / USD pair. Yesterday, the pound sterling lost only a few base points, and the activity on the instrument declined dramatically. Markets are also waiting for the results of the G-20 meeting. Thus, it is unlikely that there will be strong movements in the market for both pairs today. In the case of the pound / dollar, it is still not clear whether the instrument is ready to build an upward set of waves. An unsuccessful attempt to break through the maximum of the supposed wave d suggests that there is none. But then, you should find out if the markets are ready to continue the descending part of the trend and complicate it. There is no answer to this question yet. Thus, what remains is that we should wait first for the completion of the G-20 summit, and then breaking through either the maximum of wave d or the minimum of wave e.

Sales targets:

1.2434 - 161.8% Fibonacci

1.2359 - 200.0% Fibonacci

Purchase goals:

1.2767 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument has changed and is now suggesting the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break the maximum of wave d, which confirms the willingness of the markets to further increase, and only then, we can buy the instrument.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română