Over the previous week, the dollar has strengthened quite noticeably, but it only took Monday and Friday, and all the other days, the market tritely trampled on the spot. And if we talk about Friday, then everything is very simple, since it is connected with the publication of the report of the United States Department of Labor. Its content turned out to be somewhat different from what was expected, and rather even better than forecasts. On the one hand, the growth rate of the average hourly wage did not accelerate, but remained unchanged. But this is more likely due to the increase in the unemployment rate from 3.6% to 3.7%. After all, if the number of applicants for each job is growing, it makes no sense to raise wages. And in theory, this should have been enough for the dollar to begin actively taking positions. However, the unemployment rate itself has grown due to an increase in the share of the labor force with the total population of 62.8% to 62.9%, so the increase in unemployment is not caused by some problems in the economy, but by common demographic factors. For the most part, these include the students who have received their diplomas yesterday, and rushed in search of the work of their dreams. In other words, it is a seasonal factor. And the fact that nothing terrible happened, it indicates the number of new jobs outside of agriculture, of which as many as 224 thousand were created against 72 thousand in the previous month. While it was expected that only 160 thousand will be created, the recent graduates may quickly land on their first job.

On Monday, everything happened to be a bit complicated, as the growth of the dollar was due to a number of factors. Data from Europe, especially on the index of business activity in the manufacturing sector, which fell from 47.7 to 47.6, although they waited for growth to 47.8, has marked the beginning of a confident pace amongst the portrait of the late former presidents. In addition, the growth rate of consumer lending slowed from 3.4% to 3.3%, while waiting for the indicator to remain unchanged. Then the UK entered the business, whose index of business activity in the manufacturing sector fell from 49.4 not to 49.2, but to 48.0. But oil was added to the fire by data on the lending market, which showed that the volume of consumer lending amounted to 822 million pounds against 968 million pounds in the previous month. In addition, the number of approved mortgage applications was reduced from 66,045 to 65,409. At the end of the day, the final index of business activity in the manufacturing sector of the United States was published, which did not decrease from 50.5 to 50.1, but increased to 50.6.

However, do not think that this is all and limited, the market stood rooted to the spot. This was partly due to non-working Thursday in the United States on the celebration of Independence Day, as well as the expectations of the publication of the report of the Ministry of Labor. At the same time, there are a lot of interesting data published. Thus, the total sales of vehicles in the United States remained at the same level of 17.3 million, while they predicted a decline to 17.0 million. The business activity index in the service sector rose from 50.9 to 51.5, just as and composite index. And the total number of applications for unemployment benefits decreased by 16 thousand. Well, employment increased by 1.2 thousand against 41 thousand in the previous month. But it was not without negativity, as production orders decreased by 0.7%. But European data turned out to be much more modest, and although the business activity index in the service sector rose from 52.9 to 53.6, and the composite from 51.8 to 52.2, the growth rate of producer prices slowed down from 2.6% to 1 , 6%. Much worse, retail sales growth slowed from 1.8% to 1.3%. The last two indicators, or rather their dynamics, practically leave the European Central Bank with nothing more than an urgent search for ways to mitigate monetary policy. British statistics were also rather frustrating, because the business activity index in the construction sector dropped from 48.6 to 43.1, and in the service sector from 51.0 to 50.2. So, the dollar should have been clearly strengthening already, which he did, with a short break in the middle of the week. So Donald Trump, who in fact has already started his election campaign, can safely say that he is successfully "making America great again".

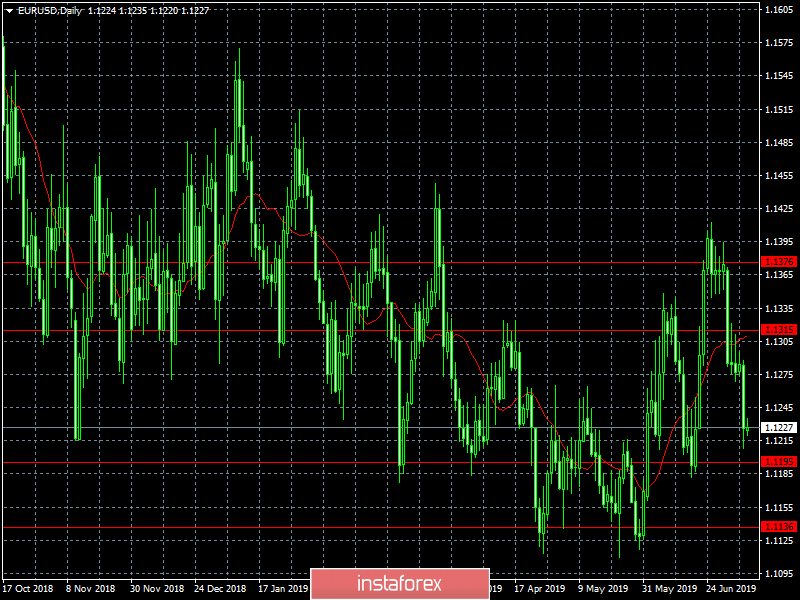

The coming week will not be so rich in macroeconomic statistics, but the importance of the output data forces the hand to reach for popcorn. Perhaps the main event of the week will be the publication of data on inflation in the United States, which is expected to show its slowdown from 1.8% to 1.5%. And not only that, this alone will force investors to take heart drops, so literally right after that Jerome Powell will speak in Congress. And it is quite obvious that the fact that inflation is slowing down will not be left out of sight of congressmen, who, due to their inexperience and simplicity inherent in the natives of the common people, will begin to ask the head of the Federal Reserve System direct and not very convenient questions. Of course, it would be regarding the plans of the regulator in terms of the refinancing rate. Moreover, the day before this, the text of the minutes of the meeting of the Federal Commission on Open Market Operations will be published. And there is almost no doubt that it will reflect the gradual drift of sentiment of the members of the Board of the Federal Reserve System towards the reduction of the refinancing rate. So this alone should be enough for the dollar to start actively losing its positions. In addition, inventories at wholesale trade could rise by another 0.4%. But it won't do without good news, as the growth rates of producer prices can accelerate from 1.8% to 2.0%, and the number of open vacancies should increase by 30 thousand. However, inflation and the content of the minutes of the Federal commissions on open market operations will still be the main focus, and both of these factors are likely to have a negative impact on the dollar.

In Europe, almost no macroeconomic data are released, and it is only on Friday that there will be published data on industrial production. However, this does not promise anything good, since the industry, which is now decreasing by 0.4%, can increase its decline to 1.6%. But do not forget about the data on inflation in the United States, as well as the text of the minutes of the meeting of the Federal Commission on Open Market Operations, so that the single European currency, despite the growing decline in industrial production, can grow to 1.1300.

For the pound, the situation is somewhat brighter, since the decline in the industry, which now stands at 1.0%, can be similarly replaced by growth all with 1.0%. Therefore, the pound has every chance of growth to 1.2625.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română