To open long positions on GBP/USD you need:

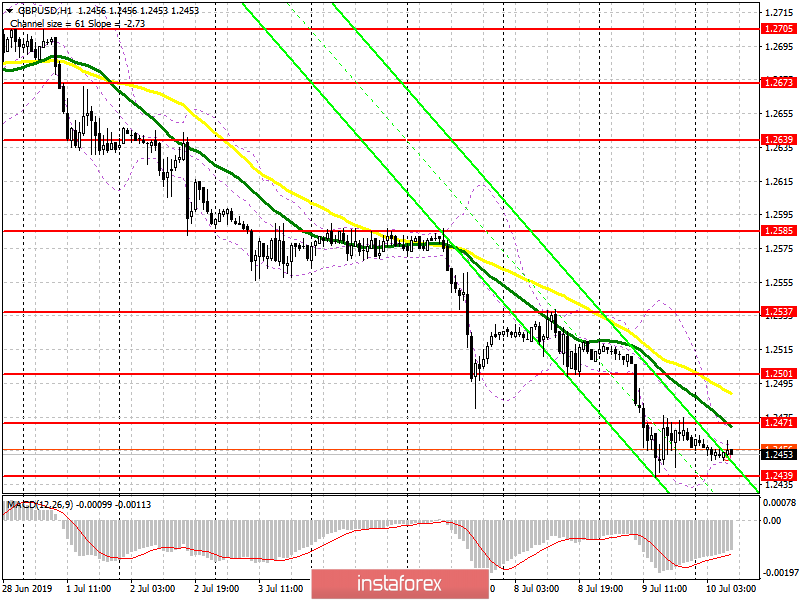

News that Boris Johnson could become the new British prime minister is putting more and more pressure on the pound. Judging by yesterday's polls - it appears so. Yesterday, buyers showed themselves in the support area of 1.2439, from which an upward correction may start today, but under the condition that a false breakdown is formed on it. If the pressure on the pound continues, and the level of 1.2439 is broken, it is best to consider new long positions to rebound from lows of 1.2405 and 1.2374.

To open short positions on GBP/USD you need:

At the moment, the sellers' goal is to break through support at 1.2439, which will maintain a downward impulse and lead to updating lows around 1.2405 and 1.2374, where I recommend taking profits. In case the pair grows after the Fed chief's speech, short positions can be returned on a false breakdown from a resistance of 1.2471, or to rebound from a high of 1.2501.

Indicator signals:

Moving averages

Trading is below 30 and 50 moving averages, which indicates the bearish nature of the market.

Bollinger bands

An upward correction of the pound may be limited by the upper level of the indicator in the 1.2471 area.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română