The widely publicized negotiating strategy of the American president clearly does not work in politics when it is opposed by an independent and economically strong power.

It seems that Donald Trump's previously applied business strategy of pressure on the enemy, followed by a slight recoil and as a result, achieving his goals only works for outright US vassals and economically weaker countries. With China, the States have failed to carry out such maneuvers and in this struggle, at least at the present stage, America is losing or more precisely, Trump personally.

The failure of the next trade negotiations between Washington and Beijing last week led to the sharp depreciation of the exchange rate of the national currency against the US dollar today, on Monday. The currency exceeded 7 yuan for one dollar. It seems that the Chinese authorities have decided to no longer coddle with the United States and struck back with an economic blow. This is indeed a serious gesture, which shows that Beijing no longer intends to try to play with the failed poker "cheat" Trump. In fact, it gives the Americans a signal - either we really agree on mutual trade on a parity basis or a real trade war will begin.

Why is this losing scenario for Trump? Everyone knows that he plans to be re-elected for a second presidential term and for this, he needs not only external "victories" in order to look like a strong president in the eyes of the US electorate, as well as positive dynamics of the local stock market. However, this is not all so positive.

The decision of the Fed to symbolically lower the key interest rate by 0.25%. At the end of the meeting last week, it showed that this is not enough to continue the steady growth of the stock market. The correction of stock indices began not only in the United States. This is a serious negative for Trump in his fight for the presidency.

Another important point is that the Fed's decision led to the opposite result. The dollar turned around and began to strengthen in the foreign exchange markets, which will adversely affect the value of American goods on the world market. This is also another negative for Trump's presidential ambitions.

Evaluating the emerging picture, we note that at the present moment the American president has bad cards in his hands and the situation will only get worse if China continues to hold a dull defense. The Chinese stock market at auction in the morning is already on a vertical peak after a strong weakening of the yuan. The same thing probably expects American and European. In any case, futures on major stock indexes are falling. It can be said that in this situation, safe-haven assets will be in demand and the dollar can continue its smooth ascent, fulfilling the role of a safe-haven currency.

Forecast of the day:

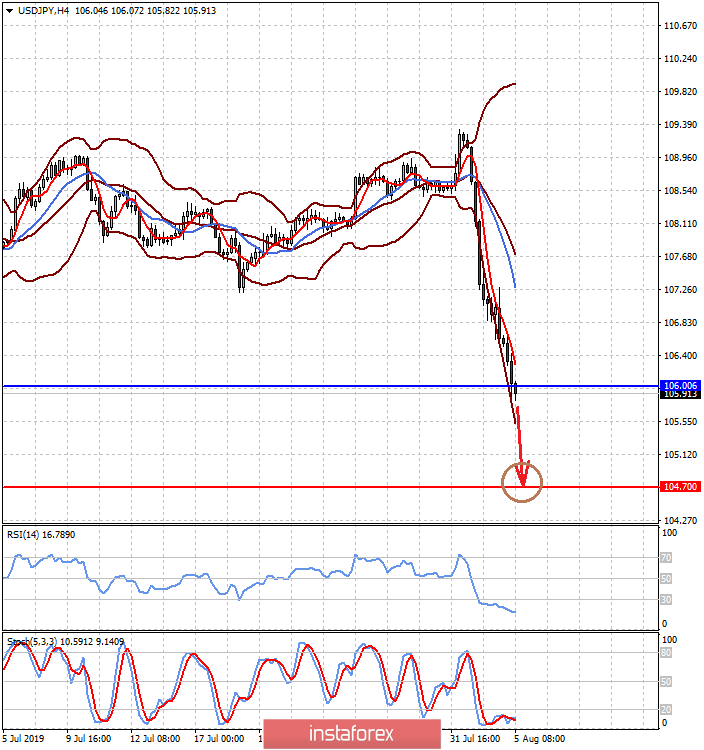

The USD/JPY pair is trading below the 106.00 level. It may continue to fall in the wake of the escalation of the trade war between the United States and China. Fixing below this mark will cause the price to fall to 104.70.

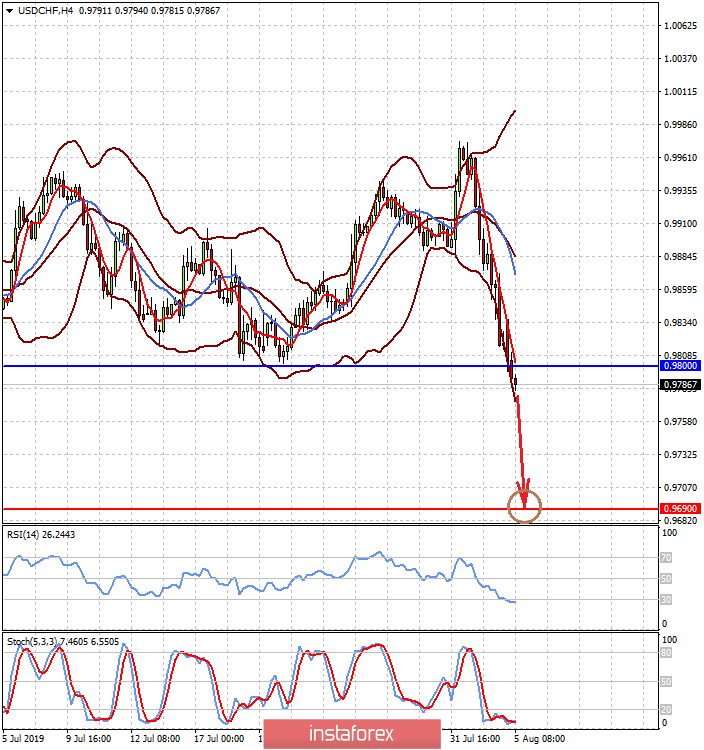

A similar picture is observed in the USDCHF pair. The departure of investors from risk will contribute to its reduction. The pair is below the 0.9800 mark and fixing below it will lead to its decrease to 0.9690.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română