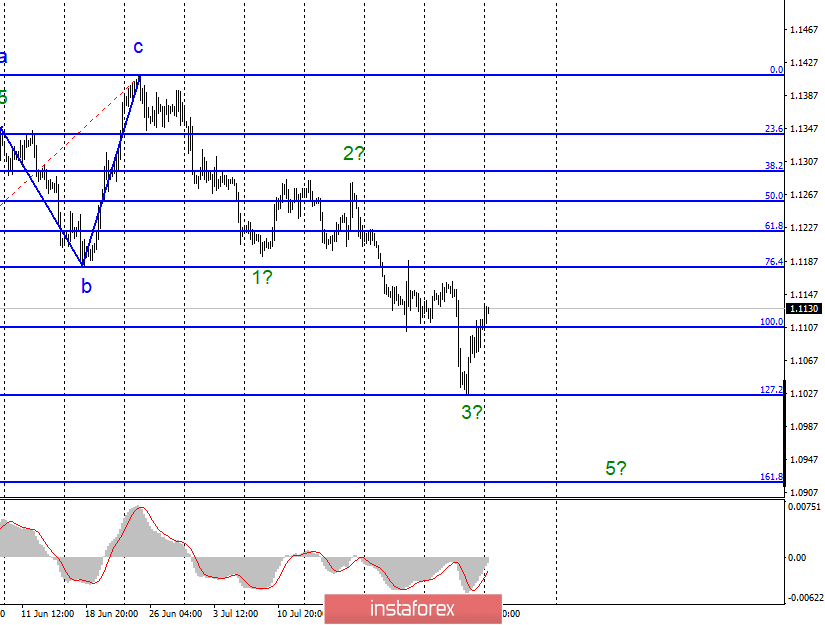

EUR / USD pair

On Friday, August 2, the EUR/USD pair ended with an increase of 20 basis points. Thus, the instrument is presumably at the stage of building an internal correctional wave in the composition of the future first wave of a new downward trend. On Friday, the news from Europe about retail sales slightly pleased the euro/dollar bulls. However, in the context of the already announced cut in the ECB rate, this news does not add too much optimism to the traders. The foreign exchange market is still headed downward, which is confirmed by the current currency movement. Trump's message on Twitter about the introduction of new duties against China is interesting, but it must be admitted that the stock market is responding to messages of a similar nature. Currency traders are more interested in economic reports. If the indicators of the state of the US economy will seriously fall as a result of Donald Trump's actions in the international arena, this may lead first to new declines in the dollar and to a new easing of the Fed's monetary policy in the future, which will entail new declines in the US currency. Today, I recommend paying attention in Europe to the index of business activity in the services sector, which since February 2019 feels not bad in principle (being between the values of 52 and 54) and not showing downward dynamics.

Purchase targets:

1.1412 - 0.0% Fibonacci

Sales targets:

1.1025 - 127.2% Fibonacci

1.0920 - 161.8% Fibonacci

General conclusions and trading recommendations:

The euro/dollar pair continues to build a downtrend trend. Thus, I recommend selling the pair with targets near the 1.1025 and 1.0920 marks, which equates to 127.2% and 161.8% Fibonacci, according to a new MACD downward signal on the construction of wave 5.

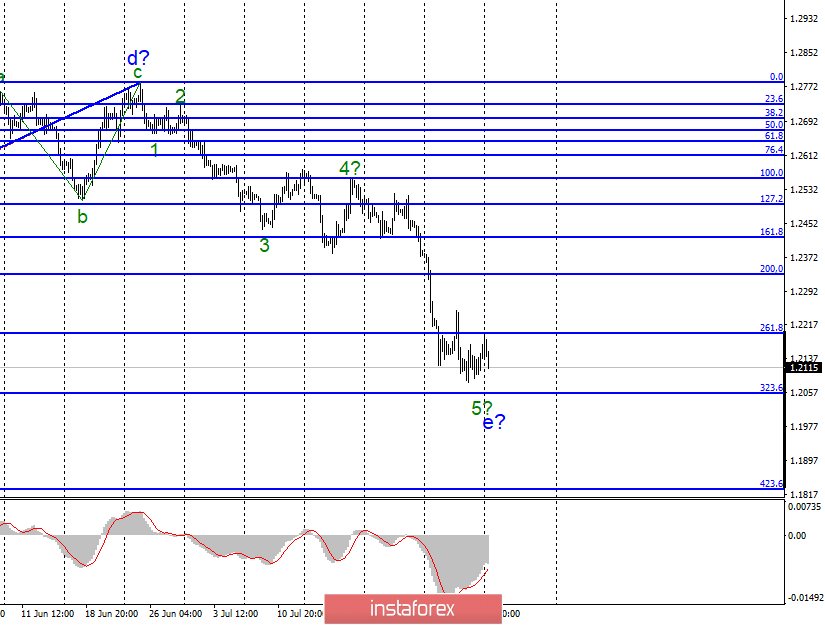

GBP / USD pair

On August 2, the GBP / USD pair gained about 30 basis points, but in total, it could not go far from the lows reached earlier, which suggests further construction of waves 5 and e. If this is true, then the MACD signal will point down to the new sales of pound pair from the dollar bears. Unfortunately, the news background for the instrument remains a failure, which does not give any reason for markets to buy a pound. The UK rushes at full speed to meet Brexit without an agreement and Boris Johnson is now more busy putting in place conditions for the European Union, trying to force him to make new negotiations on the deal. Since there is no progress so far, there's no hope for a mild Brexit with the agreement. Today, I draw the attention of traders to the index of business activity in the US service sector, which is about 52.2 and experts say that this will not change in July. However, the British business activity in the service sector is in a weak state at 50.2. True, no change for the better or for the worse is expected but this does not mean that they will not.

Sales targets:

1.2056 - 323.6% Fibonacci

1.1830 - 423.6% Fibonacci

Purchase targets:

1.2783 - 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound-dollar tool suggests the continuation of the construction of a downward trend segment. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated mark of 1.2056 and in the case of a successful attempt to break through with targets located at about 1.1830, which corresponds to 423.6% Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română